We tend to think of payments as a conscious act, made in person or online. Many payments, however, are scheduled in advance and automatically processed again and again without further action. We’re talking about recurring payments.

Definition

Recurring payments are card or account transactions occurring automatically at regular times.

UK Finance refers to recurring payments as “regular”, contrasted with “spontaneous” payments completed at a point of sale, online checkout or over the phone. In 2021, 5.8 billion payments in the UK were of the regular category, compared with 29 billion spontaneous sales. That’s 16.7% of all payments taking place – not a huge proportion, but it accounts for large volumes of money.

For some businesses, recurring payments are the cornerstone of its business model – think of subscriptions, billing and membership plans. What’s more, they can occur between businesses (B2B), employers and workers, service providers and customers. Even private individuals use it to transfer money to their other accounts automatically.

But how do they work? Let’s have a look at the characteristics, types and uses of different regular payments.

Types of recurring payments

Recurring payments is an umbrella term for the different systems we have for automating regular transactions on predictable dates.

Common to the methods is the requirement for card or account details for where your money is stored electronically. Automatic payments can only happen electronically via online banking networks, so cash and cheques cannot be used (as they are physical and require manual processing).

Let’s look at the different types of recurring payments available.

Direct Debit

Direct Debit is the most widespread payment system for recurring payments in the UK. Businesses and organisations that want the Direct Debit system have to be vetted by Bacs (operated by Pay.UK), the company behind it. It is typically used for utility bills, council tax, subscriptions and memberships.

With a Direct Debit, the account holder authorises a business or organisation to charge predetermined amounts on specific dates. An account number and sort code are required to set one up, so credit cards cannot be used.

Amounts and collection dates can be changed by the business if communicated to the account holder with a proper advance notice. Payers can, however, also cancel Direct Debits any time through their bank, but should notify the recipient in case it causes an issue.

Bacs enforces a Direct Debit Guarantee, where banks have to refund any amounts that were incorrectly taken, This means consumers generally trust the system.

Works with:

- Current accounts

- Bank accounts

- Basic bank accounts

- Some prepaid cards

Continuous payment authority (CPA)

A continuous payment authority (CPA) is when a customer authorises a business to take money on a recurring basis from their debit or credit card, usually on scheduled dates when money is owed. It’s used for many subscriptions and membership plans, such as for the gym, insurance policies and online streaming platforms.

The authorisation allows the company to charge the cardholder any time, so the payer-payee agreement is very much built on trust. In most cases, the company is well-trusted and doesn’t abuse their power by charging unexpected amounts at unpredictable times.

To set up a CPA, the long number on the customer’s card is required, as opposed to an account number and sort code. The cardholder can cancel the recurring payment, either through their card provider or by contacting the business to end the subscription.

Works with:

- Debit cards

- Credit cards

- Some prepaid cards

Standing order

Standing orders allow bank account holders to transfer a fixed amount to a person or business on a specified date every week/month/year/other frequency. It’s a useful banking tool for automating bank transfers on a schedule to another account, for any reason.

Banks have no obligation to reverse mistaken standing orders, though. It is in fact the account holder’s responsibility to check that the amounts and dates are correct, while the recipient cannot amend it.

Standing orders are commonly used for paying rent, putting away regular savings and a mix of other practical purposes.

Works with:

- Current accounts

- Bank accounts

- Basic bank accounts

- Some prepaid cards

Bacs Direct Credit

Direct Credit is a Bacs-operated system used by businesses, charities and government departments in the UK.

It facilitates timely bulk payments such as salaries, wages, benefits, supplier payments and pensions directly to people, contractors or businesses, where the amounts and timings are scheduled in advance.

The service is very reliable and preferred by payees, since funds are immediately cleared and accessible on the scheduled payment day.

An organisation or business can set up Bacs Direct Credits through their payment service provider, who facilitates the payments. Along with recipient account and payment details, the business needs to submit certain documents for approval.

Works with:

- Current accounts

- Bank accounts

- Building society accounts

- Savings accounts

- Some prepaid cards

When are they used?

From both merchant and consumer perspectives, the above recurring payment systems are not all equal. They each benefit specific situations.

Firstly, Direct Debits are often viewed by consumers as the safest alternative. The Direct Debit Guarantee protects payers whilst holding businesses to account so they can’t just charge any amount without a clear advance warning. Not all businesses qualify for this payment method, however, but account-to-account payment providers such as GoCardless have lowered the threshold for those wishing to offer it.

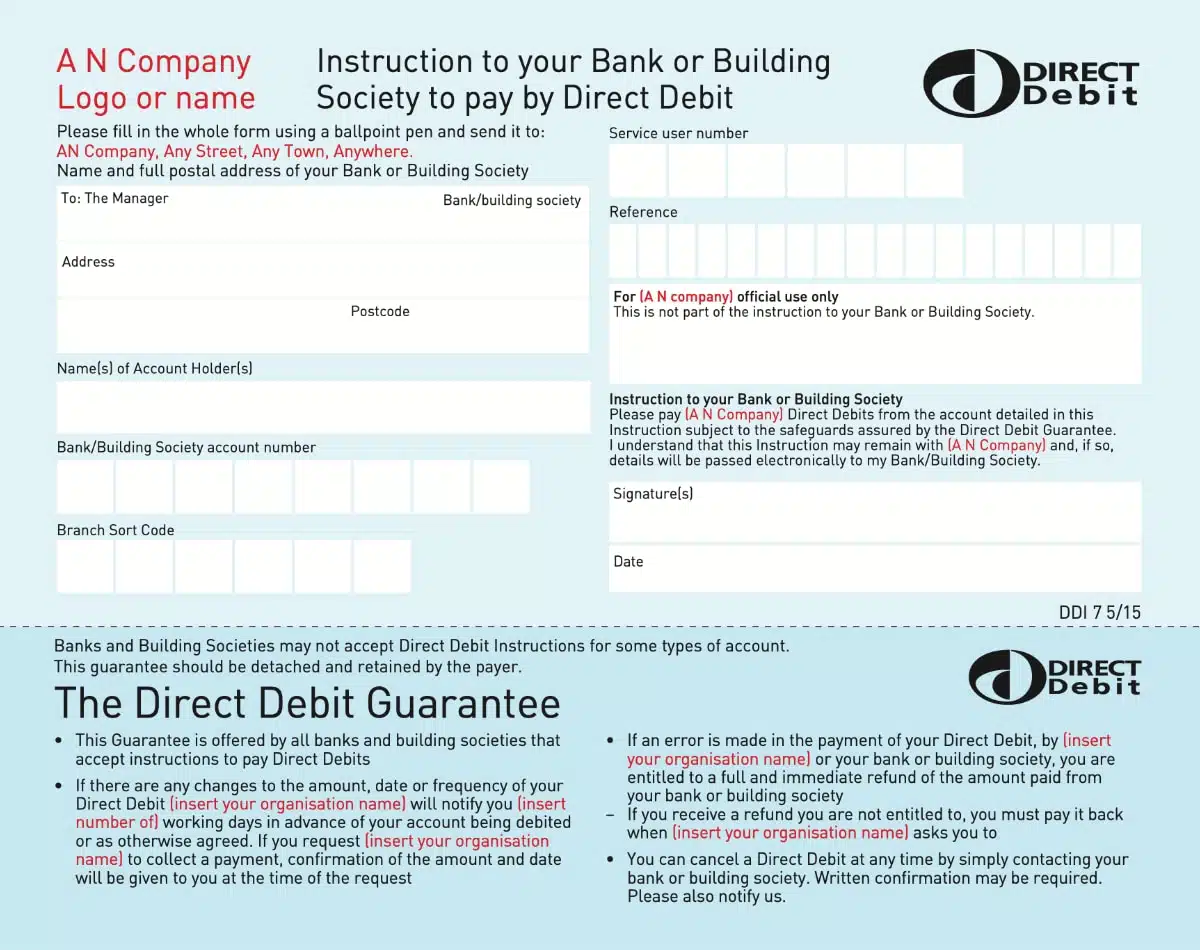

Credit: Bacs

Example of a Direct Debit form given to the prospective payer to authorise future payments.

Typically, the customer is given a Direct Debit form (above image) by the business to instruct their bank to set up the payments.

A downside of Direct Direct is the time it takes for the first transaction to clear: usually 1-2 weeks. But this isn’t a huge deal for long-term services like gas, electricity and water bills, Council Tax, phone bills, and mortgage or rental payments.

In contrast, standing orders are akin to normal bank transfers that are just scheduled in advance by the payer. The receiver of funds cannot amend the standing order, so usually agrees with the payer when they would like to receive payments. The payer’s bank has no obligation to reverse standing order transactions, so the payer should not forget to cancel it when the bank transfers are no longer needed.

You can also use standing orders purely for managing your own finances if you have multiple accounts. Someone might, for example, want to auto-transfer specific amounts to specialised accounts for savings, food and leisure budgets every month following pay day.

Bacs Direct Credit is mainly for bulk-paying multiple accounts reliably on time. Businesses and organisations use it for payrolls, ongoing supply orders and regular government payments to e.g. benefit claimants. The money is immediately accessible on the scheduled dates and does not need time to clear, since it uses a crediting instead of debiting system.

Continuous payment authority (CPA) is often used for consumer services. You know CPA is the system if a subscription registration requires your long debit, prepaid or credit card number instead of a current account number. For example, Square Virtual Terminal shows an option for recurring payments, and it uses the long card number to process transactions – so this is CPA.

Often, CPA is more accessible to consumers since it doesn’t require having a bank account. Most people have some sort of a card. However, businesses must cancel a CPA if the customer withdraws their consent to charge their card on a recurring basis. A small business has to take the rules seriously around keeping customer data secure, which means deleting all card information on request and only using a CPA for customer-authorised payments.