Looking for the Revolut Reader Ireland review?

Photo: Emily Sorensen (ES), Mobile Transaction

The Revolut card reader we tested.

The solution is geared towards registered companies and sole traders in the UK with a Revolut Business account. To qualify for payment acceptance, you also need to apply for an additional Merchant Account after your business account is approved.

Revolut is an e-money account, not bank account, but it can be used like a current account with its own IBAN for international transfers. What’s more, you can create different currency accounts to keep GBP, USD, EUR and other currencies separate.

Accepted cards

All transactions clear in your online Revolut Business account within 24 hours, so you can access and spend it with the accompanying Debit Mastercard.

You can view all transactions and use account features in the Revolut Business app. This includes sending payment links, invoicing, generating QR codes and managing cards and team members.

Pricing

The Revolut card reader costs £49 + VAT upfront, plus £5 for the DHL Express delivery. There is no option for free shipping.

The card terminal comes with a 30-day money-back guarantee, giving you the option to change your mind for a full refund. A 1-year warranty also covers the cost if it has an internal fault.

But before you can order the card reader, you’ll need to register for a Revolut Business account and then a Merchant Account enabling you to accept card payments online and in person.

There are different business account subscriptions depending on the amount of features required, but a free plan is perfectly fine for using Revolut Reader. A Company account costs £0-£100 monthly and a Freelancer account £0-£25 monthly.

| Revolut costs | |

|---|---|

| Revolut Reader | £49 + VAT |

| Shipping | £5 (DHL Express) |

| Business account | From £0/mo (depends on plan) |

| Transaction fees (tap & chip) | UK consumer cards: 0.8% + 2p International & commercial cards: 2.6% + 2p |

| Refunds | Original transaction cost is retained |

| Chargebacks | £15 each |

| Payouts | Free |

| Commitment | None |

| Revolut costs | |

|---|---|

| Revolut Reader | £49 + VAT |

| Shipping | £5 (DHL Express) |

| Business account | From £0/mo (depends on plan) |

| Transaction fees (tap & chip) | UK consumer cards: 0.8% + 2p International & commercial cards: 2.6% + 2p |

| Refunds | Original transaction cost is retained |

| Chargebacks | £15 each |

| Payouts | Free |

| Commitment | None |

Transaction fees are low at 0.8% + 2p for domestic Visa and Mastercard consumer debit and credit cards, but high for premium, corporate, commercial and non-UK cards at 2.6% + 2p. If you decide to refund a transaction, the transaction fees are retained by Revolut, though no other refund fee is applied.

Chargebacks cost £15, should a customer dispute a transaction. Next-day payouts in your Revolut account are free.

Card reader and accessories

Like other app-based card readers on the market, Revolut Reader is small and wireless. Measuring just 78 mm x 78 mm x 22 mm and weighing 106 g, it has a chip card slot below the screen and accepts contactless cards and mobile wallets over the screen.

The terminal uses the WiFi, 3G or 4G of your connected iPhone, iPad or Android smartphone or tablet to process transactions. It does not work independently.

Photo: ES, Mobile Transaction

The card reader seen from behind, next to decals.

The card reader has a small, monochrome touchscreen display surrounded by a black frame and white, plastic casing. Overall, it looks a bit retro like a 1990s gaming device, but the style is in line with Revolut’s other products.

The screen activates when connecting with the app via Bluetooth. It shows a contactless logo when ready to accept a payment or virtual PIN pad when a PIN is required, which is when you’d use the touchscreen.

The only other time we used the touchscreen was when we synced the card reader with the Revolut Business app. For security reasons, you have to tap to confirm a code on the terminal screen that matches the one displayed in the app.

Photo: ES, Mobile Transaction

Ready to accept a card.

Photo: ES, Mobile Transaction

Virtual PIN pad on screen.

What about accessories? It comes with a 1.5 m USB-C charging cable that can be plugged into an adaptor or computer. Once fully charged, it should last you over 200 transactions, which is decent for a card reader with a touchscreen.

It does not connect with a receipt printer, cash drawer or barcode scanner, so it’s unsuitable for a point of sale. It is only really intended as an impromptu card reader for on-the-go payments with a physical card or mobile wallet.

App features

As opposed to alternatives like Square, Zettle and SumUp, Revolut doesn’t have a point of sale (POS) app dedicated to in-person payments. Instead, Android and iOS users can log into their Revolut Business app, navigate to the ‘Merchant’ section and create a “Request” for money.

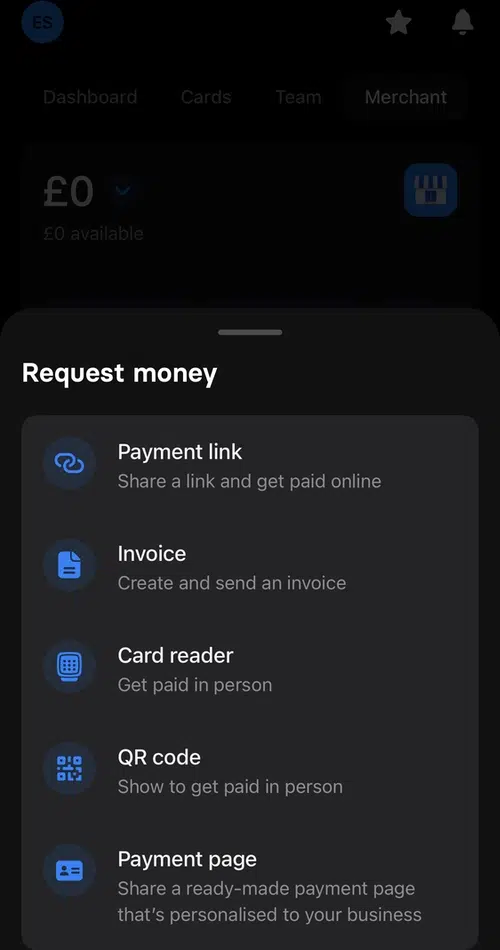

In the Request menu, you can choose between creating a payment link, email invoice, QR code, payment page or card reader transaction. All but the card reader option are for payments processed online, whereas the card reader allows you accept a chip or NFC (contactless) transaction electronically.

Unless you’ve just taken another card reader payment, the first thing that happens when creating a new request is connecting with the reader. This takes a few seconds if automatic, or slightly longer if you need to confirm the security code in the app and on the terminal screen. With leading alternatives like Square Reader, you don’t have to reconnect after a significant break.

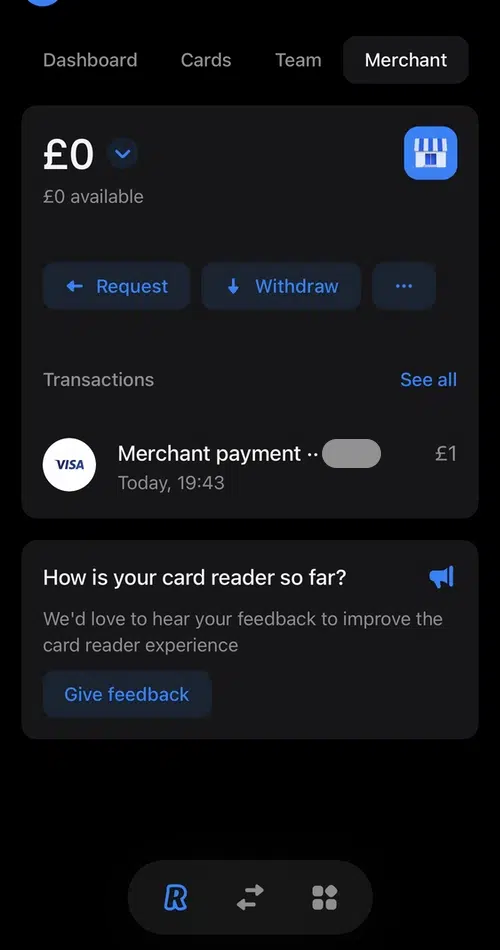

Image: Mobile Transaction

Merchant screen in app.

Image: Mobile Transaction

Payment request options.

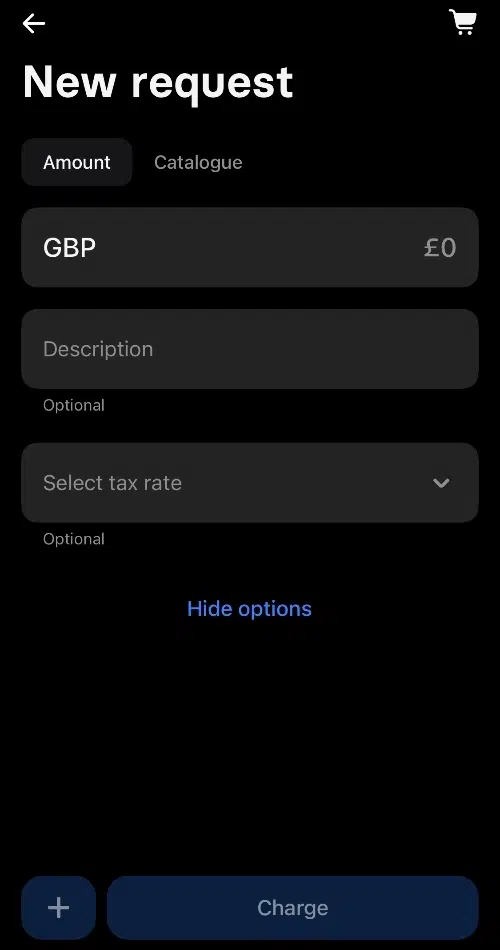

Image: Mobile Transaction

Transaction screen.

The payment screen gives you two ways to create a transaction. The default option is to add a single GBP amount and short description, which could be the product or transaction reference.

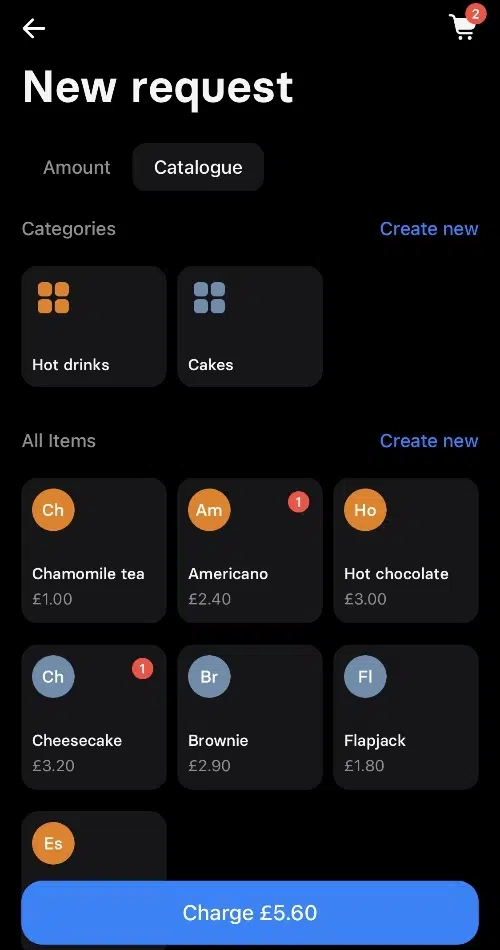

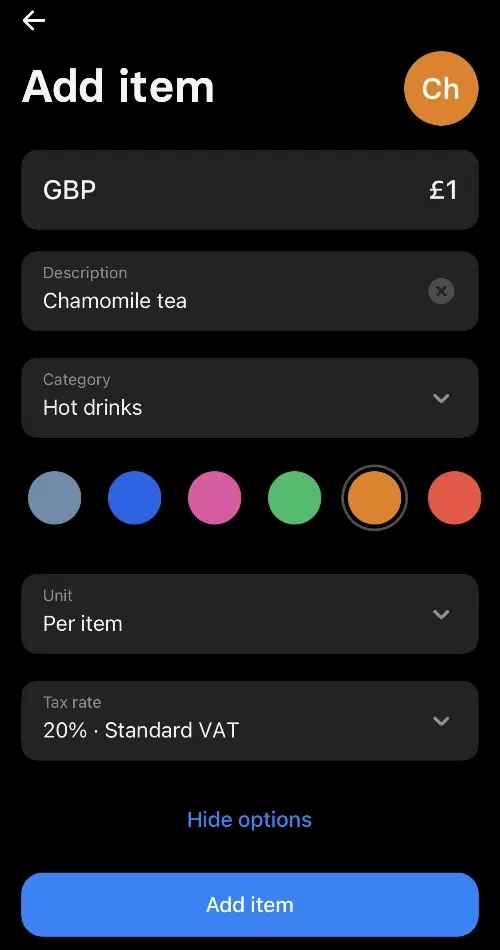

The other option is to tap items in a product catalogue to add to the cart. This requires that you’ve added items already, along with a tax rate, product category, unit type and icon colour. It’s not a fully fledged inventory system that tracks stock levels and analyses what’s selling. It’s just a means to add items to a bill quickly, and itemise receipts in the first place.

Image: Mobile Transaction

Product library.

Image: Mobile Transaction

Product settings.

Image: Mobile Transaction

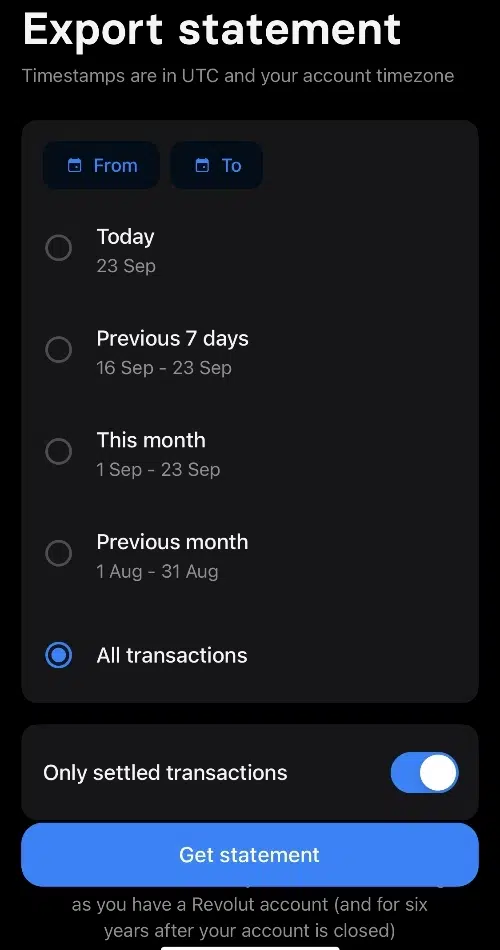

Export transactions to CSV.

When the card reader has successfully processed the payment, you have the option to send a digital receipt via a messaging app, email or text message.

Transactions can be exported from the app to a CSV file for accounting, Excel or other spreadsheet software. Revolut doesn’t give you sales analytics like showing best-selling products or times of day you’re selling more.

An overview of transactions is shown in the Merchant section. To refund a payment, you tap on the transaction and input the refund amount (partial refunds are accepted) and refund reason. The amount will then be processed back to the customer’s card.

But note: you cannot immediately refund a transaction since it is marked as ‘pending’ for a short while after the card payment went through. Only when it is ‘completed’ in your business account can you initiate a refund, and only if you have enough funds settled in the Revolut account to cover the refund amount. This could lead to some awkward moments with customers if they regret a transaction or a mistake was made.

There are no other features related to card reader payments. Apart from the Revolut Business app, the terminal only connects with Nobly, which is a hospitality POS system for cafés and small food-and-drink businesses. This gives you many more features like table plans, an inventory library and discounts.

It does not integrate with other POS apps, deeming it unsuitable for retailers or merchants who need extra features like tipping, inventory management and loyalty functions.

Revolut support, teething problems and reviews

Revolut users paying for a business account subscription can access a 24/7 chat support in the app, whereas the free plans has a more limited support chat.

We heard back from a real person minutes after initiating each support ticket on the chat, but in none of the cases could the agent solve our issues the same day – instead, it took weeks or days.

We bought the card reader as soon as it was launched, and it was apparently a beta product so it didn’t actually connect with the Revolut app. We contacted support to no avail, and it was only through testing it ourselves after some weeks that we found out.

Then the contactless function didn’t work, only chip and PIN. When the reader could accept contactless cards for the first time 2 days later, one of the transactions showed a completely different business name and location on the customer bank statement than what was true (this has still not been resolved).

Image: ES, Mobile Transaction

Box contents of a Revolut Reader package.

When we’ve asked for help in the support chat, we were passed on to different support agents and departments. Every other week, we would get an update to say they still hadn’t resolved it. You get the impression the support team doesn’t have a sense of urgency to help.

Judging from Revolut reviews, others are experiencing similarly unhelpful responses to their issues on the chat. Some have to wait for days or weeks for large transactions to be accessible in their account, while others have issues verifying their account.

Most reviews are positive about the service and features, though. And after some weeks, we were contacted by Revolut for feedback and eventually offered a replacement card reader that is working.

Our verdict: useful for sales on the go

The low price and fees for domestic consumer cards are attractive for freelancers and micro-merchants who mainly just serve local clients on the go.

The product was new when we tested it, so our teething problems would not apply to new users ordering it now. If you do run into problems, customer support may be slow to help. The included 30-day money-back guarantee and year’s warranty may ease your mind, though.

| Revolut Reader criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.2 | Passable |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.7 | Passable/Good |

| Service and reviews | 3 | Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 3.5 | Passable/Good |

| Revolut Reader criteria |

Rating | Conclusion |

|---|---|---|

| Product | 3.2 | Passable |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 3.7 | Passable/Good |

| Service and reviews | 3 | Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 3.5 | Passable/Good |

Given the lack of substantial features like tipping and sales analytics, this is only really suitable for simple transactions. If you’re using Nobly POS as a coffee shop owner, other card machines that accept more card brands would be a more reliable alternative.

New features are added every month, so it may become a more substantial service over the next year.

In addition, Revolut Business account holders benefit from having a card reader integrated with the account, with next-day settlement included. The business banking features, online payments and multi-currency accounts are real benefits for borderless freelancers and companies alike.