Looking for the reviews of SumUp US or SumUp Ireland?

Get a SumUp Air card reader for just £39 + VAT. No monthly fees or contract. Free delivery in 2-3 working days.

Mobile Transaction is an independent payment industry resource trusted by over a million small businesses per year.

We allow solution providers to offer product discounts for the benefit of our readers. These discounts do not influence our editorial content such as reviews or recommendations. Ratings are based on full retail price. (Full policy)

You just sign up (takes 5-10 minutes), purchase a SumUp card reader and pay a fixed rate per transaction. There are no hidden fees or fixed monthly costs for most of the products, but an optional SumUp One subscription is available to lower the rates.

Apart from using a card reader, you can accept payments remotely via payment links, an online store, email invoices and keyed transactions. QR codes can be generated for touch-free payments in person.

Transactions are processed through the cloud, allowing real-time access to sales figures from SumUp App or the web-based Dashboard.

The complimentary business account with a Mastercard allows you next-day access to funds, unless you prefer settlement in your bank account.

SumUp rivals Zettle and Square with its low costs, superb value and ease of getting started.

Accepted payments and payouts

The card readers accept chip (PIN or sign) and contactless NFC payments from any credit or debit card with the Visa, V Pay, Mastercard, Maestro, JCB, UnionPay, Discover, Diners Club or American Express logo. The mobile wallets Apple Pay, Google Pay and Samsung Pay are accepted too.

UnionPay is an exception for the Solo terminal – this is still not accepted on it.

Consumers may also pay with the e-wallet SumUp Pay containing a virtual Mastercard that collects loyalty points only to be redeemed at stores using SumUp.

Accepted cards

The minimum possible payment amount is £1. Customers can tap a contactless card or phone for amounts up to £100 without entering a PIN, but the card terminal will require authentication for amounts above. There’s no transaction limit on Apple Pay and Google Pay payments.

What about remote payments? Mastercard, Visa, American Express, Diners Club and Discover are accepted online, but not UnionPay or JCB.

As default, SumUp initiates payments – minus the transaction fee – to your bank account or SumUp Business Account daily. It takes 2–3 working days to clear in the bank account, whereas the SumUp account receives funds the following day. You can also choose to be paid weekly or monthly on a schedule.

You can get next-day payouts to your bank account on the SumUp One subscription (£29 + VAT/month).

SumUp App lets you register cash payments, but not cheques.

They are all wireless and portable, ideal on the go or at a till point when stationed in their corresponding charging dock.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

SumUp Air, Solo and Solo Printer duo.

The cheapest model, SumUp Air, costs only £39 + VAT because it does not work independently. Rather, this wireless reader connects to your smartphone or tablet via Bluetooth, working in tandem with SumUp App to process chip and contactless cards.

SumUp Air is compatible with most Android tablets and smartphones with Android 6.0 or higher, iPod Touch and iPhone with iOS 12.0 or higher, or iPad with iPadOS 12.0 or higher. Bluetooth 4.0 is required to connect it with the mobile device.

The card reader comes with a micro USB cable, which you can plug into a computer or power supply when it needs a charge (a wall plug is bought separately).

Photo: Emily Sorensen (ES), Mobile Transaction

Box contents of our SumUp Air delivery.

You’ll get about 500 transactions out of a full charge. Busy stores may want to opt for a charging station, which not only keeps the Air charged all day, it also looks good and keeps the reader in place on a countertop.

The card reader is smooth and stylish with a glass surface and plastic base that’s nice to hold in the hand. It’s tamper-proof, meaning any external effort to manipulate its technology will shut it down so it can’t be used any more. That’s great for security, but you need to make sure it’s not near highly magnetic fields, which could inadvertently deem it permanently unusable.

If you need to print paper receipts, Air works with compatible receipt printers available at an extra cost. SumUp’s listed options are all mobile Bluetooth printers that connect with the app on your mobile device. A cash drawer can be linked to it, but only via a receipt printer.

Photo: ES, Mobile Transaction

Chip card slot and power button of Air.

Photo: ES, Mobile Transaction

Charging socket of Air.

Then we have a card machine that doesn’t require a mobile app: SumUp Solo with (£139 + VAT) or without (£79 + VAT) a receipt printer. It is the newly-launched model to replace the discontinued SumUp 3G and Printer. The Solo + Printer duo is the cheapest UK card machine that prints receipts.

Solo has a crisp-clear touchscreen that is visible enough in direct sunlight. On the display, you just enter an amount, transaction description (optional) and proceed to accept a chip or tap payment.

It has a few useful features like smart tipping, refunds and adjustment of screen brightness. Solo is not, however, connected to a product library, cannot accept special payment methods like gift cards, and cannot link to any POS system (or other hardware) like Air is able to.

Photo: EC, Mobile Transaction

Package contents of SumUp Solo with a desk charging stand (not receipt printer).

Solo has a built-in SIM card with unlimited data, so you don’t need a connected mobile device to process card payments. This could be a handier solution for those who don’t need elaborate POS features, but instead prefer one portable device for card payments or just an extra terminal to use independently from the point of sale.

It has a shorter battery life compared with Air: up to 100 transactions. We found that Solo’s touchscreen was more power-hungry when the screen brightness was on maximum, but the terminal’s battery performance has improved since we tested it. It should now be able to last up to 8 hours without the receipt printer.

| SumUp Air | SumUp Solo | SumUp Solo & Printer | |

|---|---|---|---|

|

|

|

|

| Price | £39 + VAT | £79 + VAT | £139 + VAT |

| Works without phone/tablet | |||

| Connections | Uses phone network/WiFi | WiFi, GPRS, 3G, 4G (SIM included) | WiFi, GPRS, 3G, 4G (SIM included) |

| Size | 84 x 84 x 23 mm | 83 x 83 x 17 mm | 83 x 83 x 17 mm |

| Battery life | 500 transactions | 100 transactions | 100 transactions |

| POS integrations | SumUp App, SumUp Point of Sale | ||

| Receipt printing | Via compatible mobile printers | SumUp Solo Printer only | SumUp Solo Printer only |

| SumUp Air |

SumUp Solo |

SumUp Solo & Printer |

|---|---|---|

|

|

|

| £39 + VAT | £79 + VAT | £139 + VAT |

| Works without phone/tablet | ||

| Connections | ||

| Uses phone network/WiFi | WiFi, GPRS, 3G, 4G (SIM included) | WiFi, GPRS, 3G, 4G (SIM included) |

| Size | ||

| 84 x 84 x 23 mm | 83 x 83 x 17 mm | 83 x 83 x 17 mm |

| Battery life | ||

| 500 transactions | 100 transactions | 100 transactions |

| POS integrations | ||

| SumUp App, SumUp Point of Sale | ||

| Receipt printing | ||

| Via compatible mobile printers | SumUp Solo Printer only | SumUp Solo Printer only |

Essentially, the Solo reader is intended as a standalone solution and does not connect with any other POS software or equipment. It only works with its SumUp Printer attachment (doubling as a power bank), not other receipt printers.

The power bank is actually an excellent backup for mobile merchants – other card terminals on the market don’t usually have this.

Photo: EC, Mobile Transaction

The SumUp Solo terminal and printer combo is the cheapest UK card machine with receipt printer.

It’s possible to link several SumUp terminals to your main account, but you cannot link any other brand of card machine to it.

Fees: low, fixed rate and no monthly charge

No ongoing or monthly fees apply to SumUp by default – you only pay a flat rate of 1.69% per card reader transaction, which is lower than Zettle’s and Square’s fixed rate. The payment terminals are purchased upfront and owned by you, but can be returned for a full refund within 30 days if you change your mind.

Given the lack of contractual commitment, termination fees or monthly minimum sales volume, you’re not charged anything if you don’t make sales for any length of time. This is great for fluctuating sales, seasonal businesses or anyone making £5,000 or less per month in card payments.

| SumUp general charges | |

|---|---|

| SumUp card machines | SumUp Air: £39 + VAT SumUp Solo: £79 + VAT SumUp Solo & Printer: £139 + VAT Free shipping and 30-day money-back guarantee included |

| Account creation | Free |

| Contract | No lock-in, no exit fee |

| Monthly cost | Free |

| Card reader transactions | 1.69% (any card) |

| Refunds | Free before payout, transaction fee after |

| Chargeback fee | £10 |

| Minimum monthly sales volume | No minimum, no fees |

| Invoice, online & link payments | 2.5% per transaction |

| QR code payments | No transaction fee |

| Virtual terminal & keyed payments | 2.95% + 25p per transaction |

| SumUp general charges | |

|---|---|

| SumUp card machines | SumUp Air: £39 + VAT SumUp Solo: £79 + VAT SumUp Solo & Printer: £139 + VAT Free shipping and 30-day money-back guarantee included |

| Account creation | Free |

| Contract | No lock-in, no exit fee |

| Monthly cost | Free |

| Card reader transactions | 1.69% (any card) |

| Refunds | Free before payout, transaction fee after |

| Chargeback fee | £10 |

| Minimum monthly sales volume | No minimum, no fees |

| Invoice, online & link payments | 2.5% per transaction |

| QR code payments | No transaction fee |

| Virtual terminal & keyed payments | 2.95% + 25p per transaction |

Additional payment methods are email invoicing, online store payments, and transactions via payment link (SMS, email or social app) or QR code. These are available to everyone in the SumUp account from the start.

Keyed and virtual terminal payments are 2.95% + 25p per transaction, while online transactions, payment links and email invoices cost 2.5% without a monthly subscription. QR code payments are currently free to accept, i.e. no transaction fee is charged.

Chargebacks always have a processing cost of £10, applicable when a customer disputes a card transaction with their bank.

Refunds are free if processed before the money is settled in your bank account. After that, you can only process refunds if there are enough outstanding payouts (money not yet settled in your account), and SumUp will charge you the transaction fee originally paid.

With an optional subscription, SumUp One, you get the following reduced rates:

| SumUp One fees | |

|---|---|

| Monthly cost | £29 + VAT per month |

| Contract | None; cancellable any time |

| Discount on SumUp Solo purchase | 50% off |

| Card reader transactions | 0.99% per transaction |

| Invoice, online & link payments | 0.99% per transaction |

| International card payments | 1% added fee |

| SumUp One fees | |

|---|---|

| Monthly cost | £29 + VAT per month |

| Contract | None; cancellable any time |

| Discount on SumUp Solo purchase | 50% off |

| Card reader transactions | 0.99% per transaction |

| Invoice, online & link payments | 0.99% per transaction |

| International card payments | 1% added fee |

The One plan is cancellable any time, so you can try it for a month or two to see if it saves money with the lower domestic rate of 0.99% for in-person and online transactions. If a card issued abroad is used for a transaction, an additional 1% fee is added, making the transaction fee (1.99%) higher than the standard 1.69%. With a lot of tourists and international customers, the plan might therefore not be worth it.

If you’re planning on buying a Solo card machine anyway, you will pay less the first month on SumUp One (because of the Solo discount) than without it. And consider how many invoices you need to send per month – more than 4 invoices requires the paid Invoices Pro plan (£7-£8 + VAT per month), but this is included in One.

Business Account and Mastercard

Don’t have a bank account? Or need faster access to funds in a dedicated online account? The free SumUp Business Account and Card offer an alternative way to get paid the next day (including weekends) instead of clearing in your bank account.

SumUp Card (or SumUp Business Mastercard) is a prepaid debit card linked to your business transactions. It can be used in physical shops, online or for withdrawing cash up to three times a month free and without monthly fees.

Image: SumUp

The account is managed in SumUp App or the browser dashboard, where you can:

The account and card features are quite basic so far. You can, for instance, not use it for cross-border transfers or more than one account holder.

SumUp App: POS features (and more)

When SumUp first launched in the UK, the purpose of its app was to link with the card reader to accept payments in person. It has since matured into something much more than that, covering most payment and business management features.

Here, we focus on its point of sale features for face-to-face merchants. The app also lets you manage the SumUp Business Account, and access the Virtual Terminal, invoicing, online store functions and customer orders.

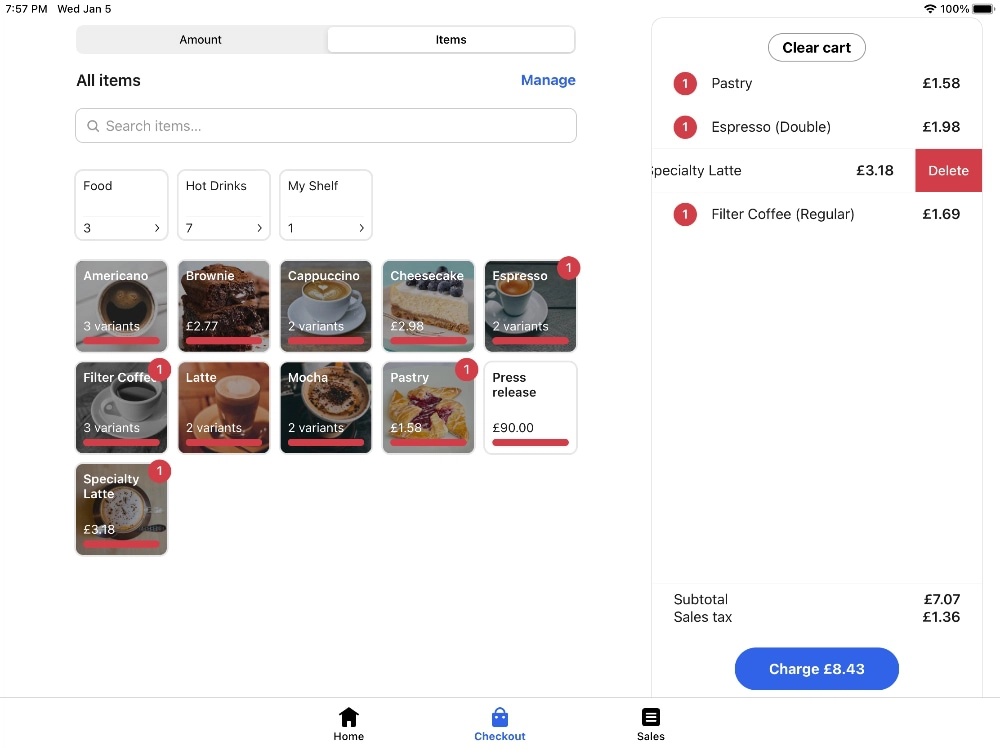

Product library: Unless you prefer to enter a transaction amount with optional description, you can add products with an image, category, tax rate, variants and prices. Items are shown in a checkout menu so you can easily tap to add them to the bill.

Image: Mobile Transaction

The product menu is user-friendly on iPad.

You can create different category labels, e.g. “Hot Drinks” and “Food”, shown as separate tabs on the screen to switch between. However, SumUp does not track stock levels or allow you to add more than one level of variants per product.

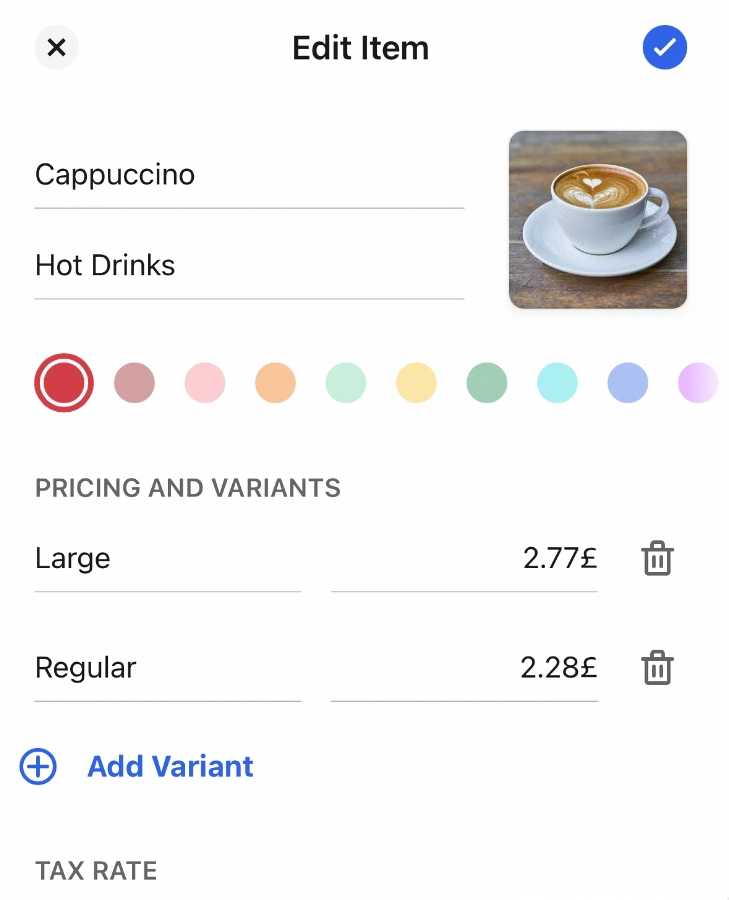

Image: Mobile Transaction

Add products with item details.

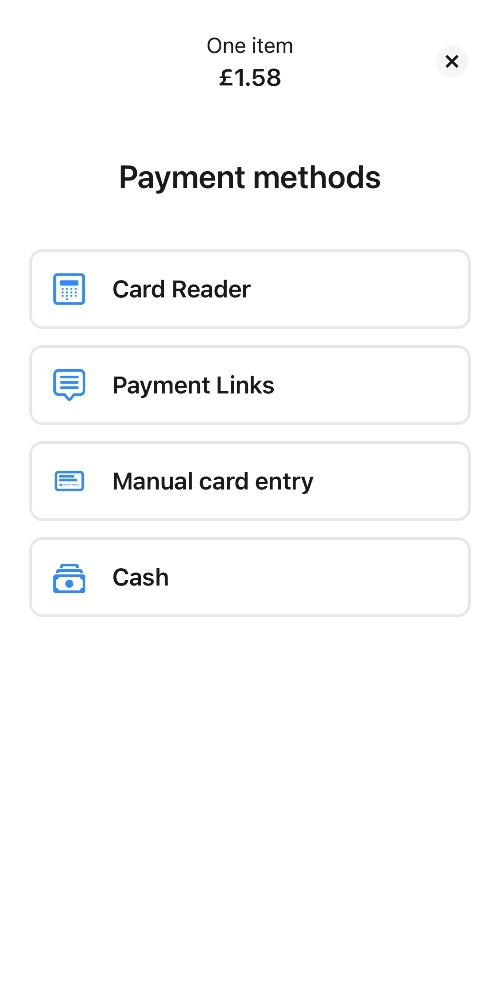

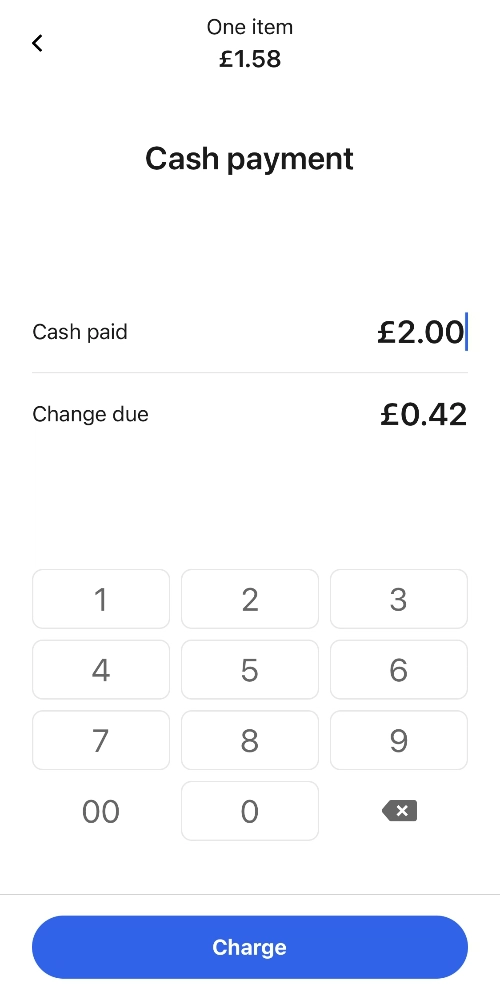

Payment options: Accept cards (via SumUp Air), cash and tips.

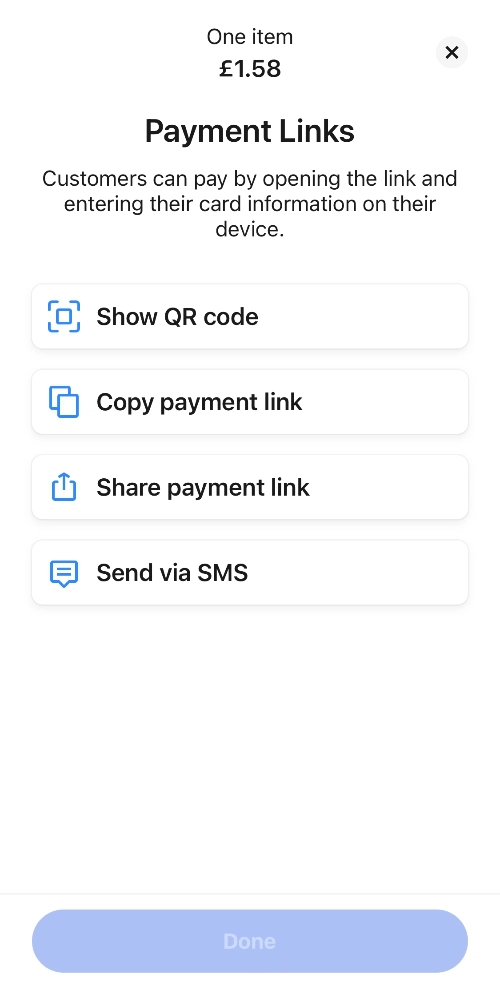

If ‘Payment Links’ is switched on, you also see options to send a payment link or text message, or generate a QR code that the customer can scan to proceed on their phone – a great way to take payments face to face without a card reader.

Keyed card entry is displayed for users with a virtual terminal activated.

The app does not accept custom vouchers, cheques or other special payment types. You cannot accept partial payments, splitting between cash and card.

Image: Mobile Transaction

Payment method screen.

Image: Mobile Transaction

Cash transaction.

Image: Mobile Transaction

Payment link options.

You can, however, accept SumUp Gift Cards. Customers can purchase these online from a fixed link you share via social media, text, email or messaging app. The customer then receives the virtual gift card over email.

Receipts: Taxes can be shown on the receipt, as enabled in your settings. After each transaction, you can send a receipt via email or text or print it. Alternatively, you can share it to an app on your – or a nearby – device via the cloud or Bluetooth.

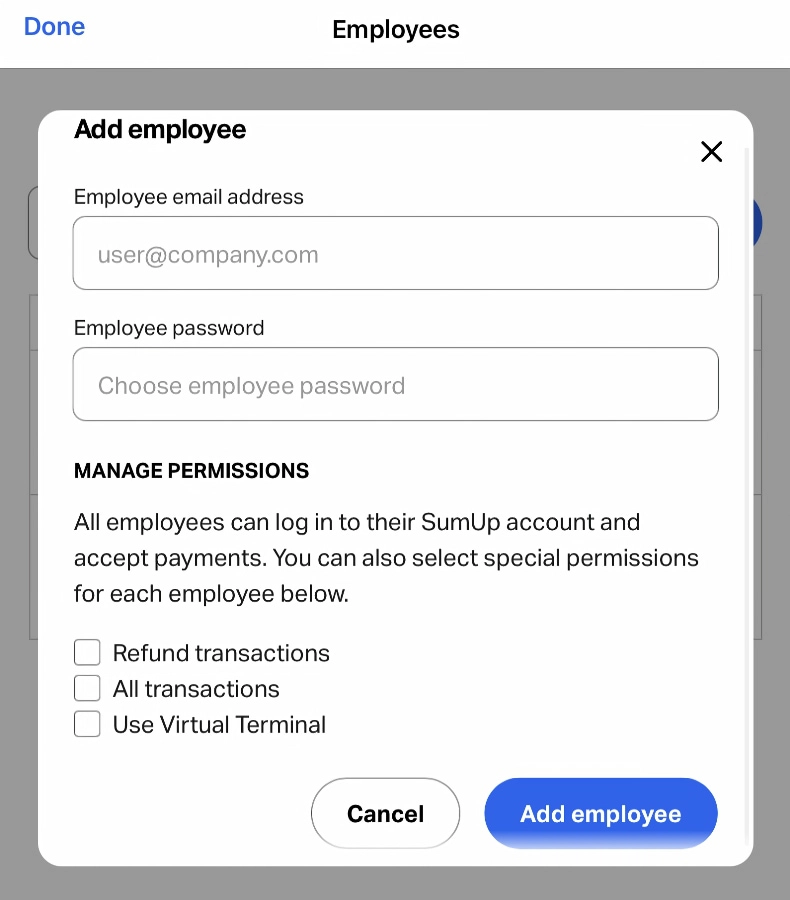

Image: Mobile Transaction

Staff accounts can have refunds and transaction overviews restricted.

Refunds: Refund a complete or partial transaction amount via the original payment method. If the customer paid by card, the refund is processed to that card. A refund can only process if there is enough balance, i.e. outstanding payouts currently underway to your bank account, to fund it.

Reports and analytics: View a list of transactions and payouts, and filter these according to a time period.

Staff accounts: Create multiple staff logins with basic restrictions, including whether they can view all transactions, process refunds or use the virtual terminal (if activated).

In the browser dashboard, you can sort transactions according to users to monitor sales activities.

POS integrations

Merchants can upgrade to a more extensive, but still easy, POS system called SumUp Point of Sale (previously Goodtill).

This is a modular POS system allowing you to add the features relevant to your industry, such as restaurant, customer loyalty and online ordering features. The basic POS software costs £29 per month, with additional modules added to the price.

A few external POS systems are also compatible with SumUp Air, such as Loyverse and Vend. Consequently, you shouldn’t be afraid to start with the really simple SumUp App if all you want is to receive payments now, but later anticipate growth.

Those looking for an order-and-pay solution can get a SumUp Kiosk. This is a big self-order, touchscreen station you can place in store, where customers can add food or products to their bill, then pay on the attached SumUp Air reader. You get a custom quote for this starting at £49 + VAT per month.

Online payments: plenty of simple options

SumUp has come a long way in terms of remote payments since before the Covid pandemic – and these tools are included free in your account.

For a start, Payment Links allows you to create a transaction in the SumUp App, then choose one of the following:

Food and drink businesses will benefit from SumUp’s multi-use QR codes for individual items to print and display at tables, the counter or in the window. This allows customers to scan the code with their phone and place an order without staff interaction.

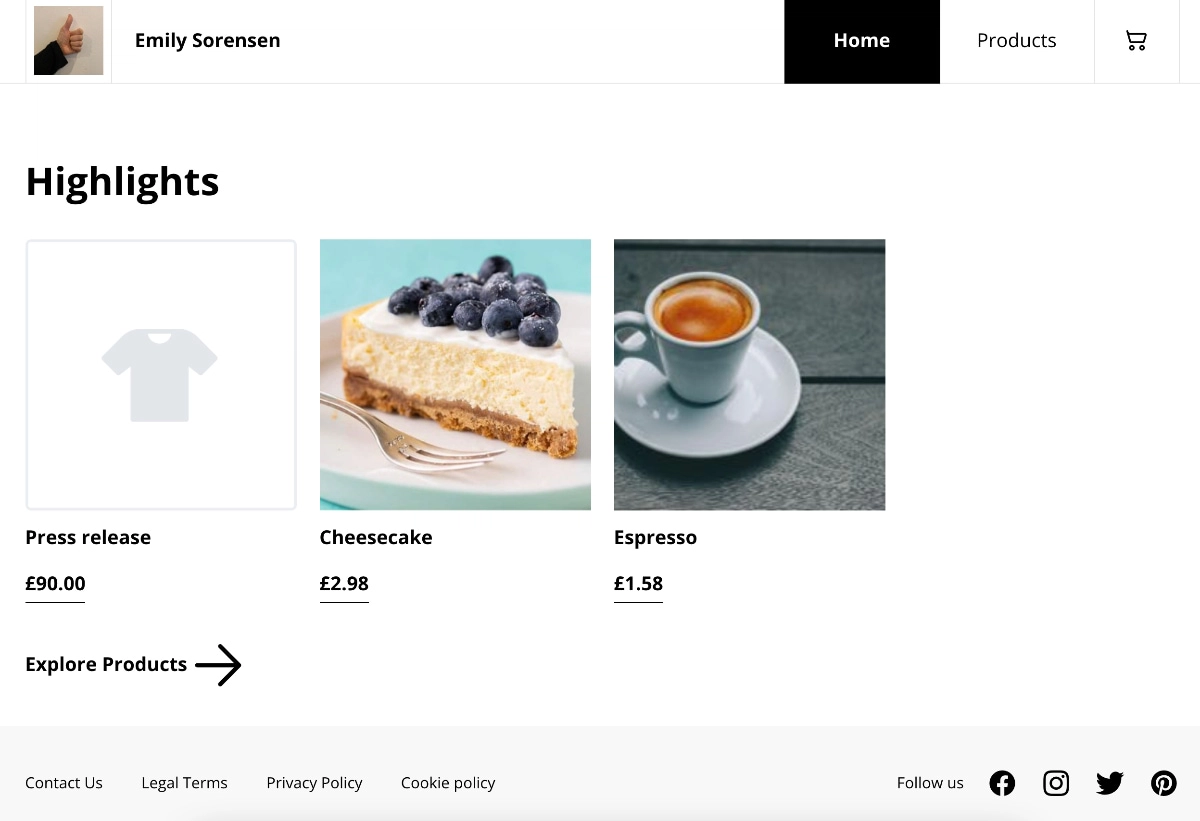

Click-and-collect and delivery orders can be placed online through the very basic SumUp Online Store. It lets you create a simple web page (through the app, no less!) with products, collection and delivery options. Order notifications are sent so you can prepare shipments or collections promptly. It’s not a perfect system, but it does the minimum needed to manage orders from your phone.

Image: Mobile Transaction

An online store through SumUp is extremely basic, but free, and lets you sell online easily.

The website is, however, extremely basic. There are not many editing options and practically no style choices, so it’s nothing like ecommerce platforms such as Squarespace and Shopify. Instead, you can edit basics like terms and conditions and collection hours, and you get a free page to share on social media to keep sales afloat while you’re not trading in person.

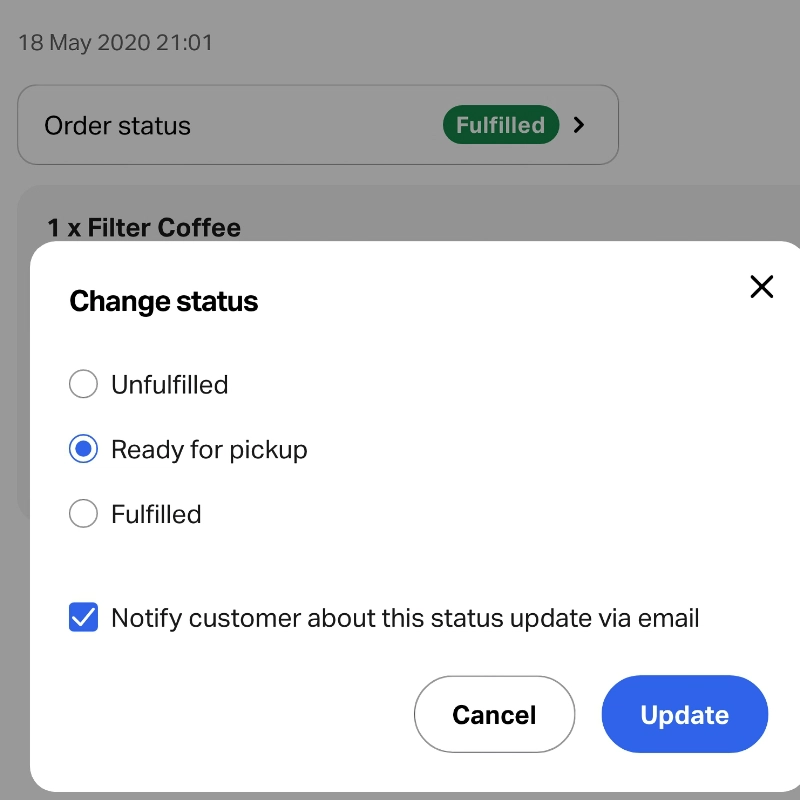

Image: Mobile Transaction

Selecting an order status.

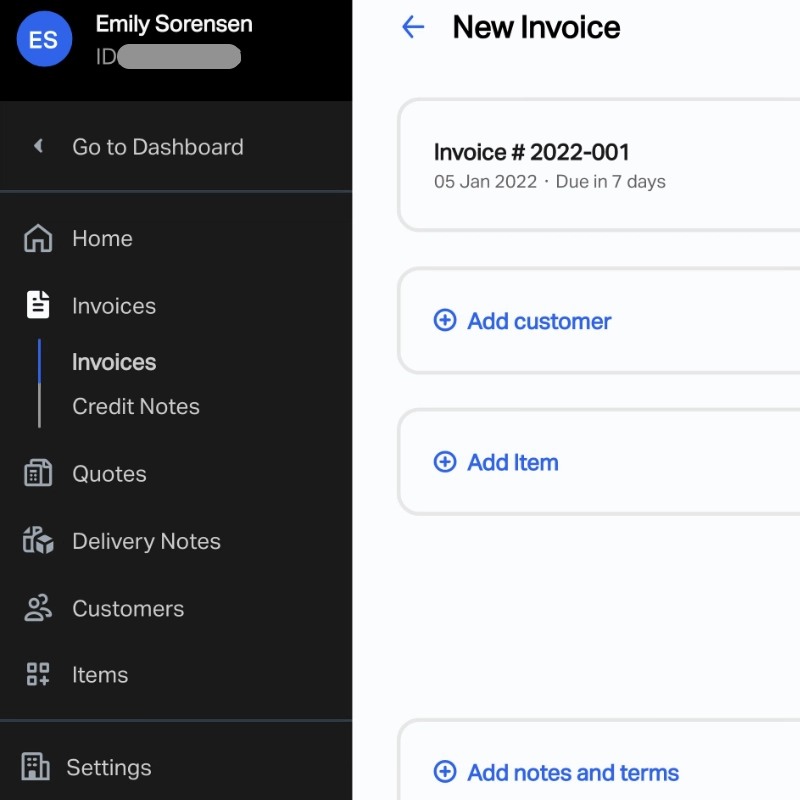

Image: Mobile Transaction

SumUp Invoices menu in Dashboard.

Alternatively, you can send and manage email invoices from the app or the Dashboard for more features. This includes sending quotes, credit notes and itemised invoices with customer details, and you can generate delivery notes. The recipient can pay through a SumUp payment link (fee applies) or make a free bank transfer.

The Free Invoices plan lets you send 4 invoices per month, with payouts going to your SumUp Business Account. Unlimited invoices, bank account settlement, 14 languages and a reduced fee on online transactions (1.25%) are included on the Invoices Pro plan (£7 + VAT/month on annual plan, £8 + VAT/month paid monthly).

What if you need to process a card payment on behalf of a customer? Eligible users can activate a Virtual Terminal, accessible in both the app and web dashboard. It allows you to enter a transaction and card details, then finalise the payment while talking to the customer over the phone.

SumUp is one of the only payment companies that allow you to use a virtual terminal from a mobile app. Other providers typically only have a web version to use on a computer.

Accounting

For reporting options, it’s best to log into the SumUp Dashboard in a web browser. Apart from its basic sales overview within a selected time period, you can export your sales history from a particular day, week or month to a CSV file for accounting.

Payout reports are sent via email when settlements are completed and are downloadable as a PDF file.

You cannot integrate SumUp with external accounting software, so it is not the best system for automated bookkeeping.

Photo: ES, Mobile Transaction

SumUp is a convenient choice for beauty salons and small businesses in general.

Who is SumUp best for?

SumUp suits sole traders, entrepreneurs and small businesses requiring an extremely user-friendly card machine and versatile features for remote selling too.

Market stalls, artists and makers, independent shops, taxi drivers, tradesmen, beauty salons, barbers and hairdressers like the straightforwardness of the platform. Many cafés and restaurants also use SumUp, sometimes with a more advanced POS system.

SumUp is designed to suit businesses that don’t need more than a few card readers – anything more, and you probably want a more complex POS system that tracks stock levels, staff movements and more.

You can use many SumUp readers in the same account, but the lack of location management can make it hard to monitor who did what.

Outside traders working a lot in the sun can go for either SumUp Air or Solo reader which has a bright, adjustable screen viewable in the sun. The display on the old SumUp 3G (now replaced with Solo) was hard to read in strong sunlight.

Photo: ES, Mobile Transaction

SumUp Solo’s screen is visible in strong sunlight.

Those travelling abroad for business – to trade shows, for example – can use SumUp on their travels if prior arrangements have been made with the customer service team. This arrangement is available for almost all of Europe.

Customer service and user reviews

SumUp’s online support section will answer the majority of questions. To contact customer support, you can phone them on weekdays between 8am and 7pm and weekends between 8am and 5pm. To put that into context, the closest competitors, Zettle and Square, only offer weekday support, not Saturdays or Sundays.

Alternatively, you can always email SumUp, but getting a reply can take days, sometimes weeks. We’ve experienced response times of over a month for non-urgent queries, but you can deal with pressing issues on the phone or through a contact form in your account during working hours.

Users tend to rate SumUp highly compared to several other mobile card readers, but it is not a perfect service.

For example, people have complained about lack of support when they needed it. There have also been card reader issues, e.g. some users have said their old card reader has stopped working for no reason, forcing them to buy a new terminal after the warranty is up.

Photo: ES, Mobile Transaction

The SumUp Air in its charging dock looks great at a till point – here seen in a restaurant.

Sign-up and eligibility

SumUp accepts registered sole traders and businesses with a bank account owned by the organisation, business or self-employed person. Not-for-profit organisations and private individuals may be accepted too, provided they meet certain criteria. SumUp can advise further on this if you get in touch.

As with all payment companies, there are certain high-risk business types SumUp will not support, e.g. multi-level marketing, any kind of adult entertainment, door-to-door sales and unlicensed counselling.

It’s very easy to get started: you sign up on SumUp’s website, submitting basic information about yourself and your business. Like any other payment provider, SumUp performs a check against the business details provided.

As long as you are not classed as a “restricted business”, and your bank account name matches your business name, they should accept it all pretty swiftly.

After sign-up, you can order a card terminal on the website, arriving within three working days. In the meantime, you can download SumUp App on an iOS or Android device and use the available features there.

It is also possible to buy a SumUp card reader from stores like Ryman, Toolstation, Amazon and WHSmith, but then you are likely to pay shipping charges too.

The virtual terminal can also be activated for qualifying merchants. You need to contact customer support for this and answer some questions about your business and payment usage. After reviewing your account, SumUp may add the virtual terminal to your dashboard and app.

Our verdict

SumUp is great for low-volume merchants who just need to start accepting cards, for example in a shop, café, bar, market stall or on the go.

The pay-as-you-go transaction fee is competitive below a monthly turnover of £5k-£10k. The service has a low barrier of entry with the cheap, one-off cost of the card machine, no monthly fees and no contract lock-in.

| SumUp criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.5 | Good/Excellent |

| Costs and fees | 4.8 | Excellent |

| Transparency and sign-up | 4.6 | Good/Excellent |

| Value-added services | 4.2 | Good |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.4 | Good/Excellent |

| SumUp criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.5 | Good/Excellent |

| Costs and fees | 4.8 | Excellent |

| Transparency and sign-up | 4.6 | Good/Excellent |

| Value-added services | 4.2 | Good |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.4 | Good/Excellent |

SumUp’s online payment options are super-valuable when you need to trade remotely, as we have seen during the pandemic. The click and collect features and online store are, however, basic, so eventually you may need to look elsewhere to expand these systems.

Furthermore, the SumUp app and payment terminals have just the essentials you need without compromising on efficiency and build quality. If you do need more POS features, an upgrade to a paid POS system is possible.

Bottom line: With its uncomplicated costs, easy sign-up and free extras, SumUp is a solid place to start for a wide variety of businesses.