What is it?

GoCardless is a UK-based company facilitating account-to-account (A2A) transactions in various online and remote payment contexts.

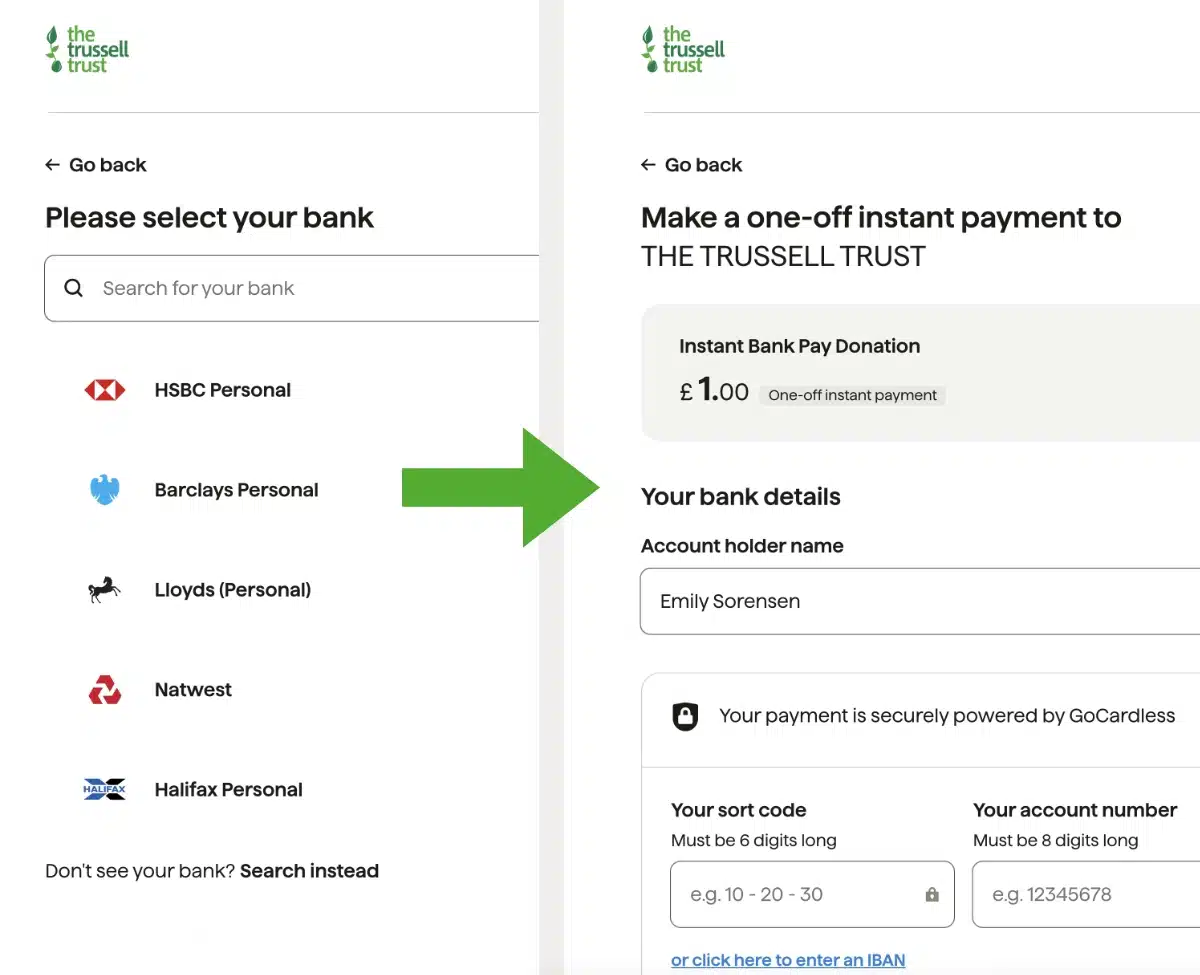

Account-to-account payments are user-friendly, direct bank transfers without intermediaries like a credit or debit card (hence the name GoCardless). Payers simply choose their bank in the online checkout and validate their account details with their banking app.

Image: Mobile Transaction

GoCardless processes bank transfers instead of card payments.

The company’s edge over traditional bank transfers is its easy web interface, fewer failed transactions and automated payment processes (e.g. email notifications) that make life easier for both merchants and payers.

Its main products include:

- One-off bank-to-bank payments completed straight away

- Subscription payments via Direct Debit

These can integrate with your existing commerce software or be managed separately in the GoCardless web portal. Businesses can also generate APIs (application programming interfaces) to build a custom solution with their online store or app.

Pricing

GoCardless has refreshingly simple and transparent fees, with several plans to suit different sizes of business.

Regardless of the plan, the transaction fee is 1% (UK and Eurozone transfers) or 2% (international transfers) + 20p, plus VAT. This is charged on a pay-as-you-go basis from your payouts in addition to any monthly fee.

International transfers are powered by Wise that uses the real exchange rate. There is no extra fee for currency conversion.

Note that VAT is added to all the fees in the UK, so the full transaction rate is actually 1.2% + 24p for domestic transfers and 2.4% + 24p for international transfers including VAT. These are still attractive for online payments, but it makes it more expensive for those who can’t claim back VAT.

You have a choice between 4 plans with the following features:

- Standard (free): Core features, multiple currencies.

- Plus: Above + your name on bank statements, colour-branded pages.

- Pro: Above + phone/in-person customer registration, fully custom pages/emails.

- Custom: Above + custom rates, priority support, dedicated solutions engineer.

| GoCardless fees | |

|---|---|

| Monthly fee* | Standard: £0/mo Plus: £50/mo Pro: £200/mo Custom: Custom fee |

| Transaction fees* | UK & Eurozone payments: 1% + £0.20/€0.20 (fee max. £4/€4) Extra 0.3% applies to transfers above £2k/€2k International payments: 2% + £0.20 (currency conversion included) |

| Failure/chargeback fee | None |

| Contract | Cancellable any time |

*Excluding VAT.

No other GoCardless costs apply, unless you are using a partner product with their own fees. UK businesses pay no chargeback fee, which is different from card payments that usually incur a charge of over £10 per disputed transaction (chargeback).

You can cancel the Standard, Plus and Pro plans any time, but the Custom plan comes with a contract explained to you at sign-up.

GoCardless’ Instant Bank Pay transactions take less than a working day to settle in your business account, whereas Direct Debits (subscriptions) take 5-6 working days to settle. The initial Direct Debit transaction can take 1-2 weeks to settle, but you can choose to accept Instant Bank Pay for the first payment to avoid that.

Features

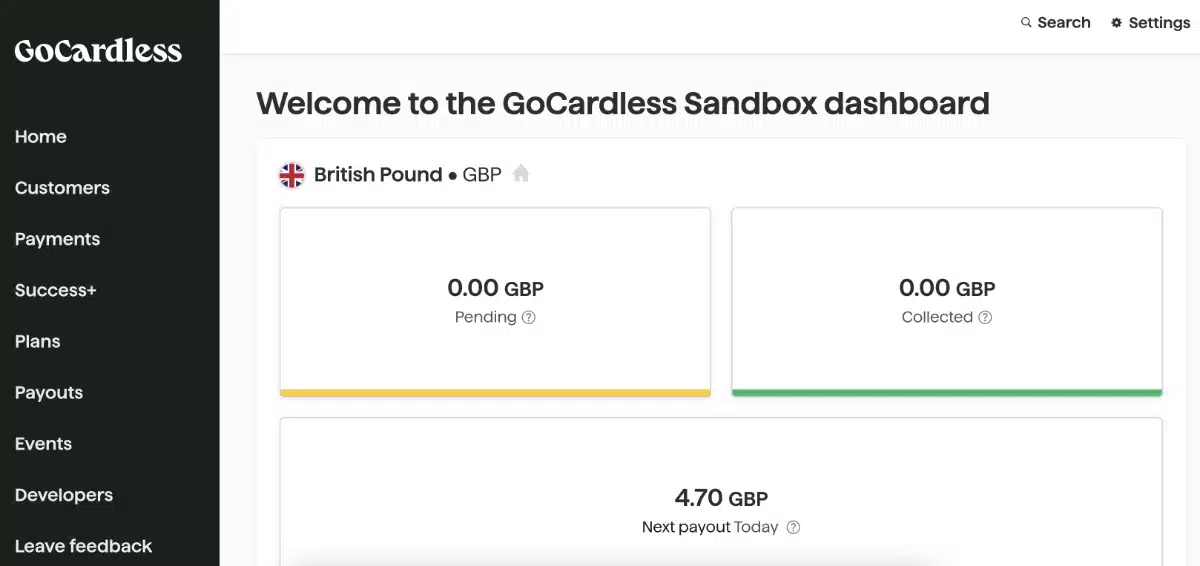

What can you do with GoCardless? We set up a sandbox (test) account to find out.

To create a user account, you just need to fill in some basic business information and contact details, then click to open your new dashboard in an internet browser.

The amount of features available to you depends on the plan you’re subscribed to. Everyone has access to these core features:

- Collect and manage subscriptions

- Instant Bank Pay (one-off payments)

- Avoid failed payments with Success+

- Ability to accept international payments

- Invite customers to create a Direct Debit online

- Integration with accounting and billing software

- Payment page with your business logo

Image: Mobile Transaction

The merchant dashboard is simple and gives a good overview of key figures.

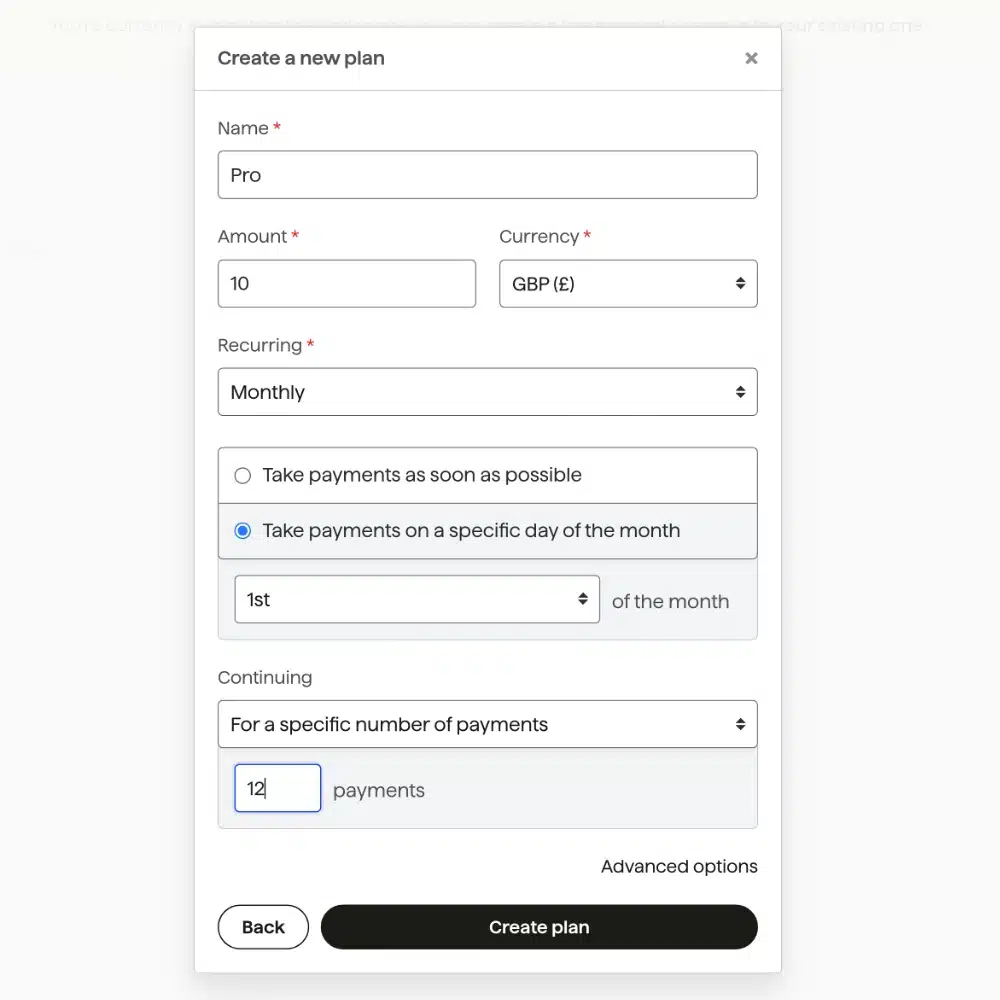

Subscriptions (‘Plans’) can be customised in the online merchant interface and shared with customers who need to pay on a recurring basis. This is done through Direct Debit in the UK, so the payer essentially gives consent to this through a streamlined interface.

It’s quite straightforward to create a recurring payment. You name the plan, amount, frequency and date of payments, whether it continues until cancelled or after a set amount of payments, and a redirect link for when the customer has finished subscribing. You can generate a link for your website that goes to the subscription checkout, or email the link directly to customers.

Image: Mobile Transaction

Subscriptions are tailored in this pop-up.

When testing, it was not straightforward to edit all the details of an existing plan (except for name and redirect link), but you can cancel and create a new plan with the correct details.

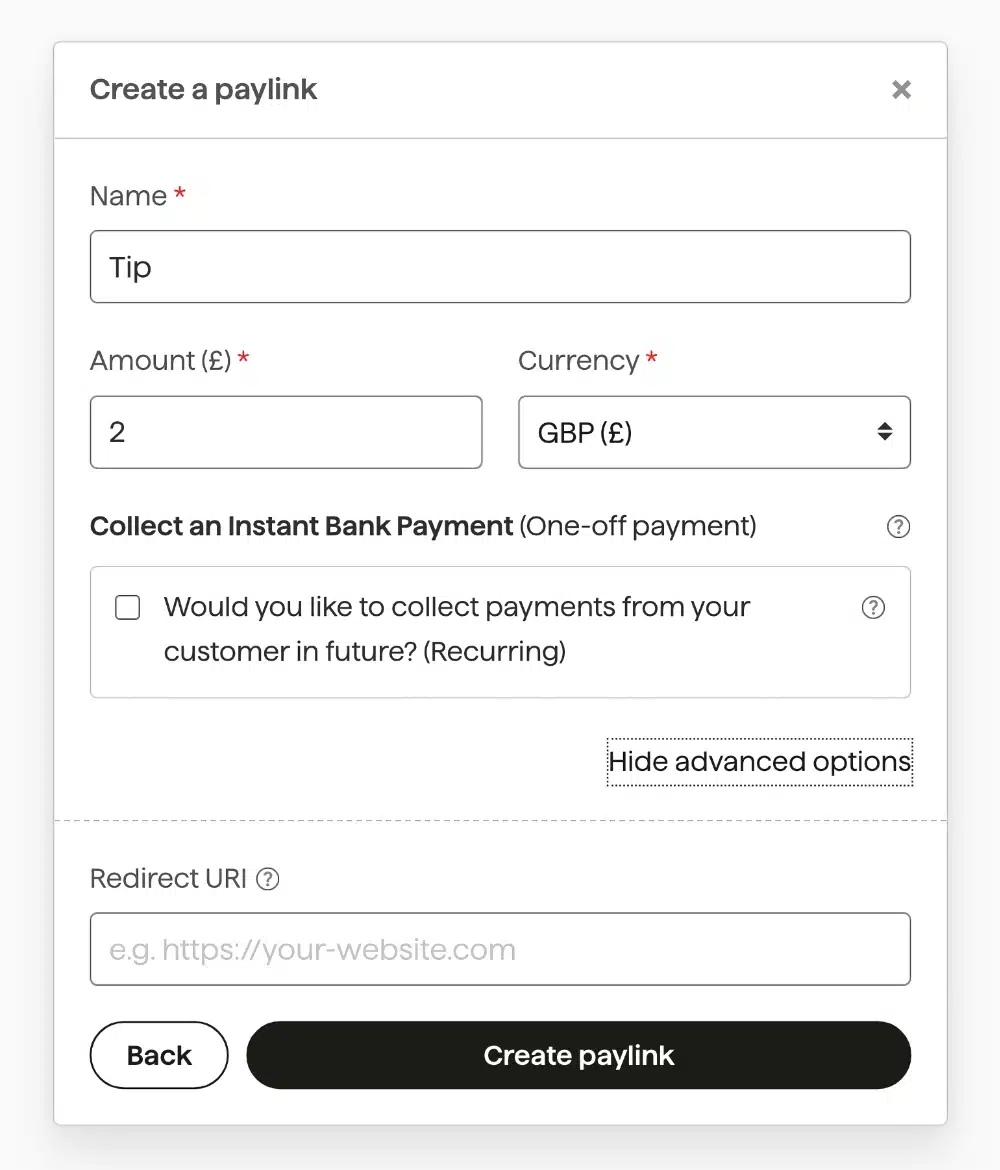

One-off payments (‘Instant Bank Pay’) are easily created in the form of a ‘paylink’. These are payment links for specified, one-off transactions via bank transfer, completed on a web page.

As with subscriptions, these payment links are easily created through the dashboard and added to a website, email, invoice, social media or anywhere else online, in-app or in messages.

Instant Bank Pay transactions can be used for the first payment of a subscription, which normally takes longer to clear. Both the customer and merchant get an instant confirmation that it’s gone through, and the funds take up to a day to settle in your bank account.

An overview of payouts (accepted payments moved to your bank account) is accessed in the dashboard. This is a useful place to track which payments have been approved, processed and cleared.

Image: Mobile Transaction

The merchant dashboard is simple and gives a good overview of key figures.

Customers can be managed and exported from the dashboard. If someone new completes a payment, they are added to this list. On Plus and Pro plans, you can add customer details manually if talking to them on the phone or face-to-face – otherwise, only customers who signed up online are added.

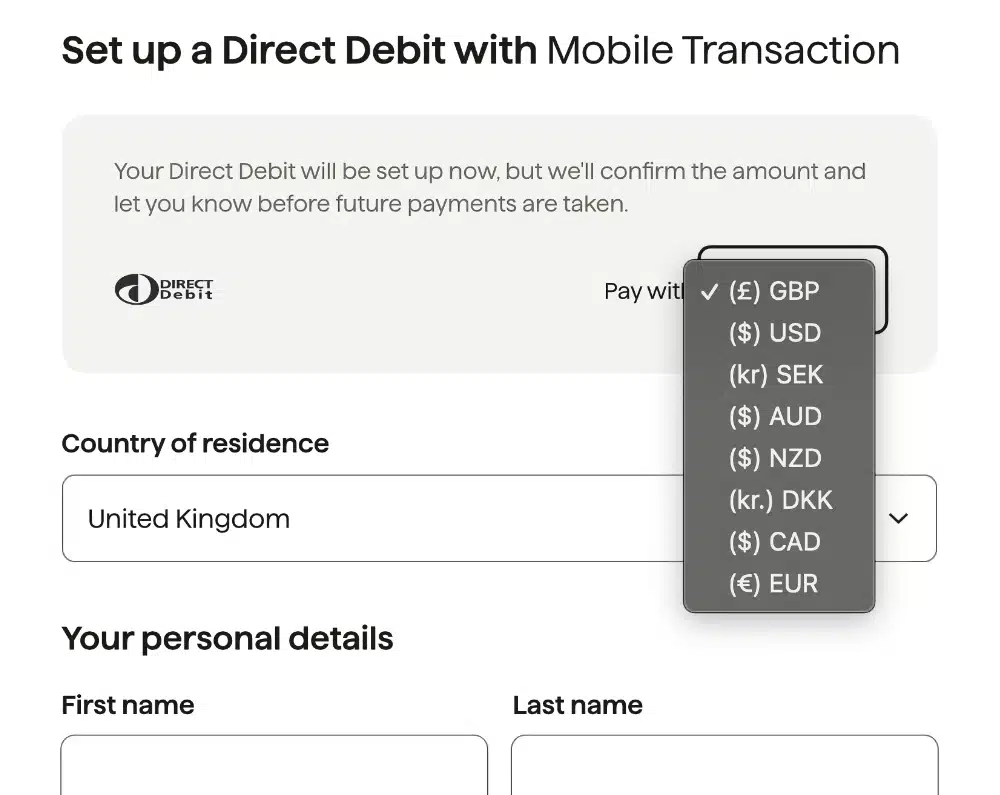

International payments are accepted in the currencies of GBP, EUR, USD, AUD, NZD, CAD, DKK and SEK. You can specify the currency for both subscriptions and one-off payments and accept bank payments from the Eurozone, US, Australia, New Zealand, Denmark, Sweden and Canada.

Image: Mobile Transaction

Payers can select their currency and country in the online checkout.

Foreign transactions use the customer’s local bank debit schemes, instead of the UK’s Bacs Direct Debit scheme.

Avoiding payment failures (‘Success+’) is another feature that GoCardless is proud to implement. It’s a system that uses intelligent mechanisms to maximise the chance of successful payments by initiating transfers during times when failure rates are reduced. Other fraud protection measures are built in (e.g. Protect+ for subscriptions) so you don’t have to worry about payment security.

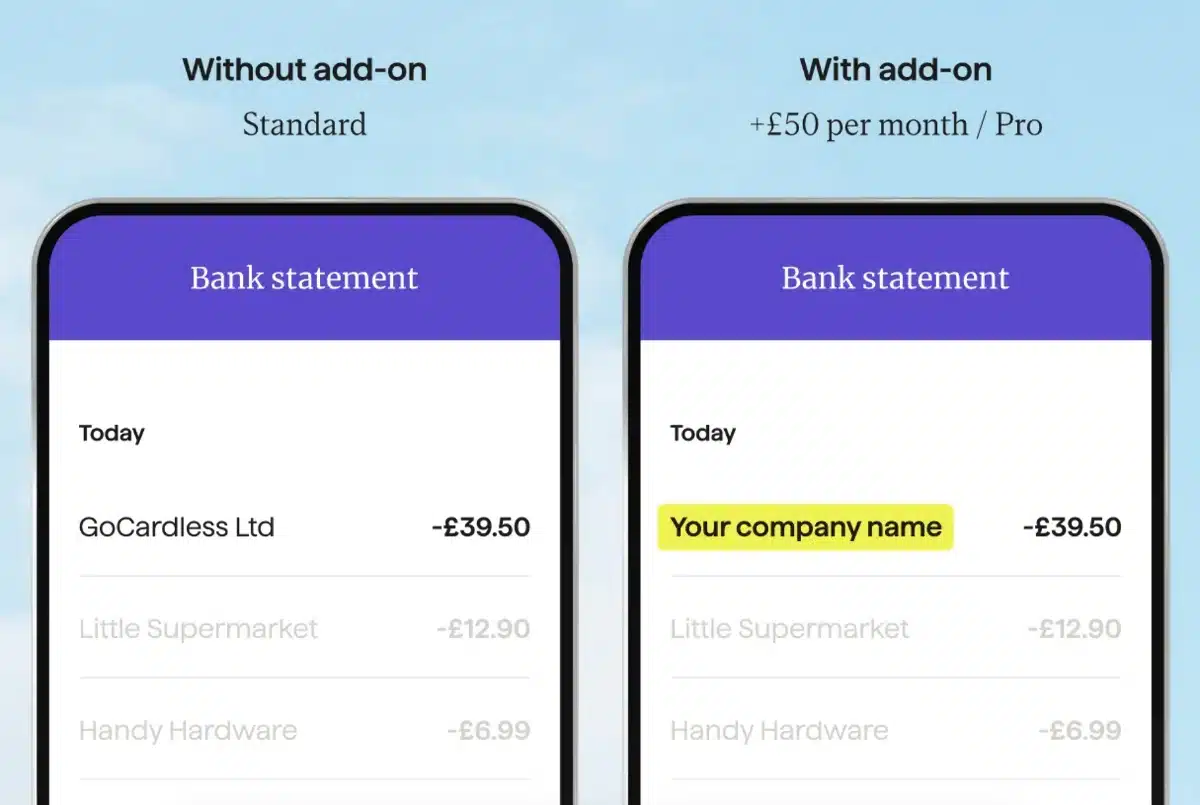

Customisation options of the payment page is limited to adding your business details and logo on the free plan. On the Plus plan, you can also choose a colour scheme for the customer-facing pages and email notifications so they align with your branding colours. On Pro, you can fully customise the payment pages and email notifications.

Perhaps the biggest downside of the free plan is the inability to specify a payment reference for customer bank account statements. This means payers will see GoCardless’ name instead of yours and might question what the payment was for. On paid plans, however, your business name will appear on bank statements.

Image: GoCardless

A paid plan is required to show your business name on customers’ bank statements.

Users can integrate GoCardless’ payment flow on their website with APIs (Application Programming Interfaces) or simply connect it with 350+ compatible ecommerce, billing, invoicing, accounting or other platforms your business is already using. This way, you don’t have to log into GoCardless’ interface to manage transactions, but can stick to where you’re usually doing your admin.

One thing that is lacking is a mobile GoCardless app. This would allow merchants to manage account features on their phone instead of having to log in via an internet browser. Of course, you can log into the online portal in your smartphone browser, but this is not as responsive or easy to do as on a large computer screen.

GoCardless compared with alternatives

So far, the UK hasn’t got a huge selection of specialised account-to-account payment platforms. GoCardless is the biggest one, but smaller platforms are emerging.

One to look out for is Atoi which suits small businesses with an in-store presence. It allows you to set up a QR code for customers to scan to complete a transaction via their banking app while they’re there in person.

Larger businesses can opt for Swedish company Brite that specialises in instant bank-to-bank payments across borders. The downside of Brite is its preference for bigger online businesses and hidden fees, leaving out individual merchants, small teams and in-person payment options.

Customer service and reviews

Customer support can be reached by email 24/7 and telephone on weekdays between 9-6pm (GMT/BST).

It’s clear from user complaints that the company prefers emailing, so you may not get a satisfactory response on the phone unless you’re a Custom subscriber paying for priority support. Custom users also get a dedicated “solutions engineer” to help with setup and issues.

GoCardless reviews are mostly positive, so it is overall a respectable platform with a high satisfaction rate.

That said, GoCardless is not free from negative reviews. Users have reported difficulties viewing pages on mobile screens (responsiveness issues) and being told to contact support in writing rather than by telephone.

Signing up for an account online is fast and easy, so you can get started with payments straight away if all goes smoothly.

Considering accepting cards instead? View card payment methods

Our verdict

GoCardless is a scalable system that makes it more accessible for merchants to accept bank-to-bank payments. Even small businesses can get started easily by signing up on the website and creating subscriptions and payment links from the web interface.

It works well for most users on a laptop, but a GoCardless app for merchants would make it more convenient to manage payments and customers on the go. Customers, on the other hand, generally experience an easy payment flow on any device with good, automated email communications to follow.

| GoCardless criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 4.2 | Good |

| Transparency and sign-up | 4.3 | Good/Excellent |

| Value-added services | 3.8 | Good |

| Service and reviews | 3.8 | Good |

| Contract | 4.7 | Good/Excellent |

| OVERALL SCORE | 4.1 | Good |

The service is generally okay, but if you prefer to pick up the phone to ask for help, this is not the most convenient solution since email support is encouraged.

Fees are best for VAT-registered businesses that can reclaim VAT, since this is added to processing rates. That said, the domestic rate is still lower than the cost of card transactions for those who are not VAT-registered. With the availability of Instant Bank Pay, even settlement is handled the same day for the same low fee.

The question is whether your customers are happy to pay by bank transfer or would prefer a card payment. In today’s world, many still prefer debit and credit cards, and not everyone has a bank account and app for it. Still, GoCardless has a free plan that’s cancellable any time, so it’s easy to trial.