Lowdown

Zettle is most famous for its card reader that works in tandem with a clever mobile app, making it possible to take payments anywhere. You just need a tablet or smartphone with a WiFi or 3G/4G connection – then you can use the Zettle Go app whilst connected with the card reader through Bluetooth.

The company was previously called iZettle with an ‘i’, but it has rebranded to Zettle by PayPal – or Zettle, for short.

The system operates a pay-as-you-go model, which has been the main driver of the company’s popularity in the UK. You simply purchase the card reader, then use it however frequently or sporadically you need to. There’s only a fixed transaction rate for card payments accepted – no monthly fee.

Cards accepted

In addition to the app, merchants get payment links, invoicing, gift cards, reporting and sales analytics tools.

Zettle accepts one of the broadest ranges of credit and debit cards among card readers in the UK. Visa, Mastercard, Visa Electron, V Pay, Maestro, American Express, JCB, Diners Club, UnionPay and Discover are all accepted, as are the mobile wallets Apple Pay, Google Pay (formerly Android Pay) and Samsung Pay.

The card reader accepts contactless and chip and PIN payments.

A new touchscreen card machine, Zettle Terminal, was launched in October 2021. As a freestanding terminal, it comes with the Zettle Go software built in and a SIM card for mobile connectivity.

Mobile Transaction

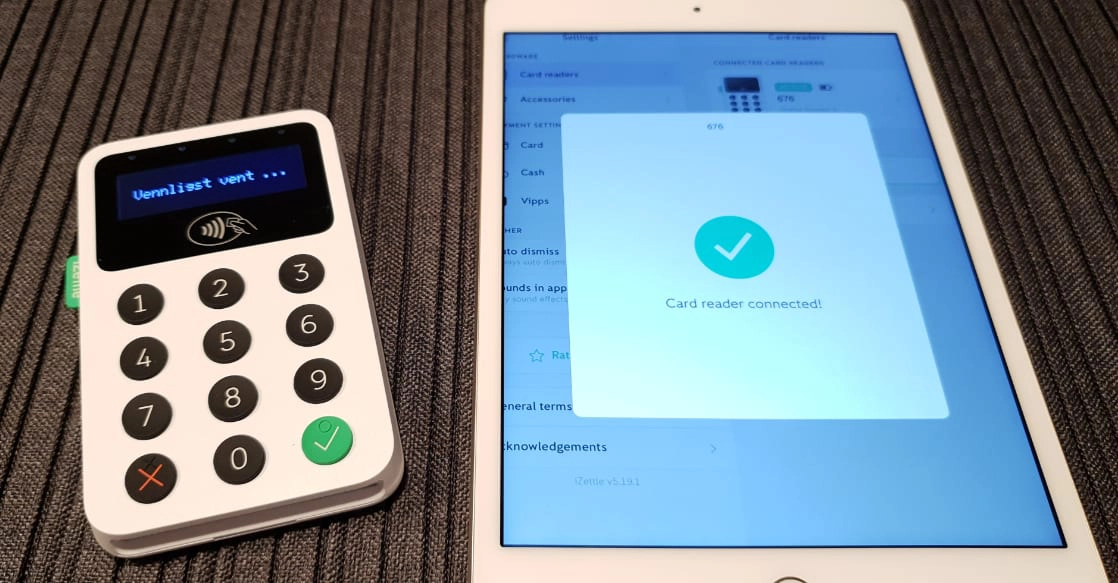

The card reader connects to a tablet or mobile phone via Bluetooth pairing.

How we rated Zettle

Mobile Transaction has assessed six key areas of Zettle to give a fair star rating reflective of its overall value for small businesses. You can read more about our rating criteria here.

A high rating is given to well-designed card readers with a fast, convenient payment process. For card readers like Zettle Reader, it means the quality and reliability of its connected app is important too. For an accurate experience, we have tested all of this.

Other than that, we consider the costs and fees, contractual terms, transparency and sign-up, customer support, user reviews, and value-added services such as software integrations and online payments.

Compare pros and cons:

Is SumUp or Zettle the best option?

Costs and fees

As well as being transparent with no hidden costs, Zettle fees are on the low side compared with similar payment solutions.

The transaction fee is a fixed 1.75% for all chip and contactless transactions regardless of card type, brand, country of issue and sales volume, e.g. foreign and premium cards cost the same to process as domestic Visa Debit cards.

Email invoices and payment links are included as complimentary tools, costing 2.5% per card payment. QR code payments via PayPal cost the same as card reader transactions, 1.75%.

| Charges | |

|---|---|

| Zettle Reader 2 | First one: £29 + VAT Additional ones: £59 + VAT |

| Zettle Dock 2 | £39 + VAT |

| Ocean Reader & Dock | £98 + VAT |

| Zettle Terminal | £149 + VAT |

| Zettle Terminal & Printer Dock | £199 + VAT |

| Shipping | Free |

| Monthly fee | None (no contract lock-in) |

| Chip, tap & QR code payments | 1.75% per transaction |

| Invoicing & payment links | 2.5% per transaction |

| Payouts in bank account | Free |

| Refunds | Free |

| Chargebacks | Up to £250 chargebacks/month covered free |

| Charges | |

|---|---|

| Zettle Reader 2 | First one: £29 + VAT Additional ones: £59 + VAT |

| Zettle Dock 2 | £39 + VAT |

| Ocean Reader & Dock | £98 + VAT |

| Zettle Terminal | £149 + VAT |

| Zettle Terminal & Printer Dock | £199 + VAT |

| Shipping | Free |

| Monthly fee | None (no contract lock-in) |

| Chip, tap & QR code payments | 1.75% per transaction |

| Invoicing & payment links | 2.5% per transaction |

| Payouts in bank account | Free |

| Refunds | Free |

| Chargebacks | Up to £250 chargebacks/month covered free |

The first mobile card reader is decent value at £59 excl. VAT, and then it costs £59 + VAT per additional reader. The limited-edition Ocean Reader, made of recycled plastic with the same tech specs as Zettle Reader 2, can be purchased with the Ocean Dock for £98 + VAT.

Zettle Terminal is more expensive at £149 + VAT for the handheld card machine, or £199 + VAT if you add the receipt printer dock or get the model with a built-in barcode scanner. All options include a SIM card with unlimited mobile data.

There are no monthly fees, rental charges, monthly minimums or other fixed costs that traditional payment providers normally charge. Since there’s no contractual commitment, “early terminal fees” do not apply either.

Transactions are cleared in your bank account within 1-2 working days, minus the transaction fee. The exact settlement time depends on your bank’s processing schedule. You can also receive payouts in your PayPal account or get detailed payout breakdowns if connected to a Starling Bank business account.

Refunds are free to process, but you must have the full refund amount in your Zettle account balance (where money is held before settling in your bank account). It’s not possible to top this up from your bank account, but you can set a minimum balance to stay in the Zettle account at any given time.

Merchants get chargeback protection for up to £250 per month if you follow best practice for taking card payments. So if, for example, a customer signs for a payment, you should compare the signature with the one on the card and ask for a valid ID.

There are transaction limits, but these are unlikely to affect most business accounts where the daily limit is £200,000. The lowest transaction amount possible is £1.

Signing up is easy

In contrast to the strenuous application processes required by traditional payment processors, you just go to Zettle’s website to submit basic details to get started.

A “unique risk assessment” involving a credit check is initiated to verify your identity, business and bank account. Only bank accounts in your company’s or company director’s name will be accepted. Charities, sole traders and partnership businesses may need to submit additional documentation.

When we tested registering as a sole trader, the automatic checks went smoothly without the need to submit more information.

We should emphasise: you can only have only one account per business or sole trader, so if you’ve already registered your name or company with Zettle, it won’t be possible to create a new account under that name.

Mobile Transaction

Box contents of an iZettle Reader 2 delivery.

After the sign-up, you can order a card reader. It usually takes 1-3 working days to receive this by post. We got it two days after placing the order. DHL sent us a text message the day before, saying when it would arrive and that a signature will be required. The package was neatly wrapped up in a padded envelope, and the card reader was ready to use immediately.

Zettle Reader 2

Zettle Reader 2 (initially iZettle Reader 2) was launched in November 2018. With the main distinguishable difference being the green button instead of a blue one, we consider it a minor upgrade from the first generation.

Zettle Reader 2 (initially iZettle Reader 2) was launched in November 2018. With the main distinguishable difference being the green button instead of a blue one, we consider it a minor upgrade from the first generation.

While the previous reader is still portrayed in some pictures, this review has been updated to reflect changes with Reader 2.

The newest card reader, Zettle Reader 2, looks very similar to the old one but has some important improvements.

The current model is slightly prettier (in our opinion), more energy-efficient and with a coating that makes it more resistant to dirt. Beneath it, you have two rubber “sausages” to keep it firmly on a countertop. We sense it’s possible to just throw it on the ground without inflicting damage (of course we do not recommend trying this – we’ve seen examples of broken displays!).

We love the minimalist design and the fact it comes in white or black, giving you the freedom to pick one that blends in with your environment.

Emmanuel Charpentier (EC), Mobile Transaction

It’s pretty straightforward to insert a chip card at the bottom.

EC, Mobile Transaction

The power button at the top is hard to press by accident.

Internet connection: To process a payment, the app connects to its servers using your mobile device’s WiFi, 3G or 4G connection. In the past, we’ve seen reports from users that they’ve had no problems using slower connections such as EDGE, so it appears the system is robust enough to work even on weak connections.

Mobile devices: In addition to the card reader and payment app, you’ll need a compatible iPhone, Android smartphone, iPad or Android tablet with Bluetooth switched on. In our experience, the Bluetooth connection with the card reader doesn’t always work and sometimes fails when it’s needed most. This has caused us lost sales and impatient customers – the last things you want when people are waiting in a queue.

We’ve also noticed that new features tend to be released in the iOS app for Apple devices first. For example, it took some time before the Android app began supporting contactless payments, but features seem to find their way to both apps eventually.

Battery: The card reader is charged with a micro USB cable. It will automatically go into sleep mode when not in use, and the battery therefore lasts longer than older models that received complaints about short battery life. Battery life is on average 8 hours with a transaction every 5 minutes, or 250+ transactions from one charge.

Businesses selling from a fixed location would want to use the card reader with a Zettle Dock – a small stand with an inbuilt charger. Placed in the dock, the card reader is automatically charged. The Dock for Zettle Reader 2 is more stable than the old one which we found a bit flimsy.

ZETTLE

Zettle is compatible with a wide range of POS equipment.

Receipt printers: Unlike chunky, traditional chip and PIN machines, Zettle Reader doesn’t have an inbuilt printer, so you have to buy that separately if you want to offer paper receipts. Fortunately, it’s compatible with a range of Star Micronics receipt printers, both stationary and mobile. The compatible printers connect either wirelessly or by cable.

Other accessories: Specific barcode scanners and cash drawers are also compatible, making it suitable for a busy, counter-based till point. Stationary iPad setups will also benefit from the Zettle tablet stand, which – apart from protecting the iPad – gives a professional feel to your customer-facing environment.

Zettle Terminal: new standalone card machine

The latest card machine model called Zettle Terminal (from £149 + VAT) works without a phone or tablet, because it has a built-in SIM card (unlimited data is included free) and touchscreen so you can use the Zettle app directly on the device.

Although advertised as having the same features as the card reader app, we noticed several features that are missing on Terminal during our tests. This includes the search field for finding an old receipt, gift card overview and certain detailed settings.

The new Terminal accepts chip and contactless cards, but the PIN pad is shown on the screen in place of a push-button keypad. You can purchase the card machine on its own or with a dock that prints receipts and charges the terminal when placed in it.

MOBILE TRANSACTION

Zettle Terminal feels like a smartphone.

My favourite part is this: the handheld card machine works directly through WiFi, or 3G and 4G when there’s no wireless internet connection. If you – like me – have had Bluetooth connectivity issues with Zettle Reader, the biggest advantage of Terminal is the fact you don’t need to link it with a phone. It simply works, as long as the mobile network or WiFi is there.

Its 5″ touchscreen interface and small size give it a smartphone feel, making it perfect for table-service, queue-busting and market stalls.

The battery lasts around 12 hours with average usage, 4-6 hours if used intensely or less with the display brightness on max. For an energy-hungry touchscreen device, this is not bad.

Taking payments

Before accepting the first payment, Zettle Reader has to be paired with a Bluetooth-enabled mobile device. This is done by following simple instructions in the app. You may have to repeat the Bluetooth pairing several times over a day if you’re not using the payment app actively (like we had to do). Sometimes, this doesn’t work at all, which is what happened to us. You can avoid this completely by using Zettle Terminal that has the software built in.

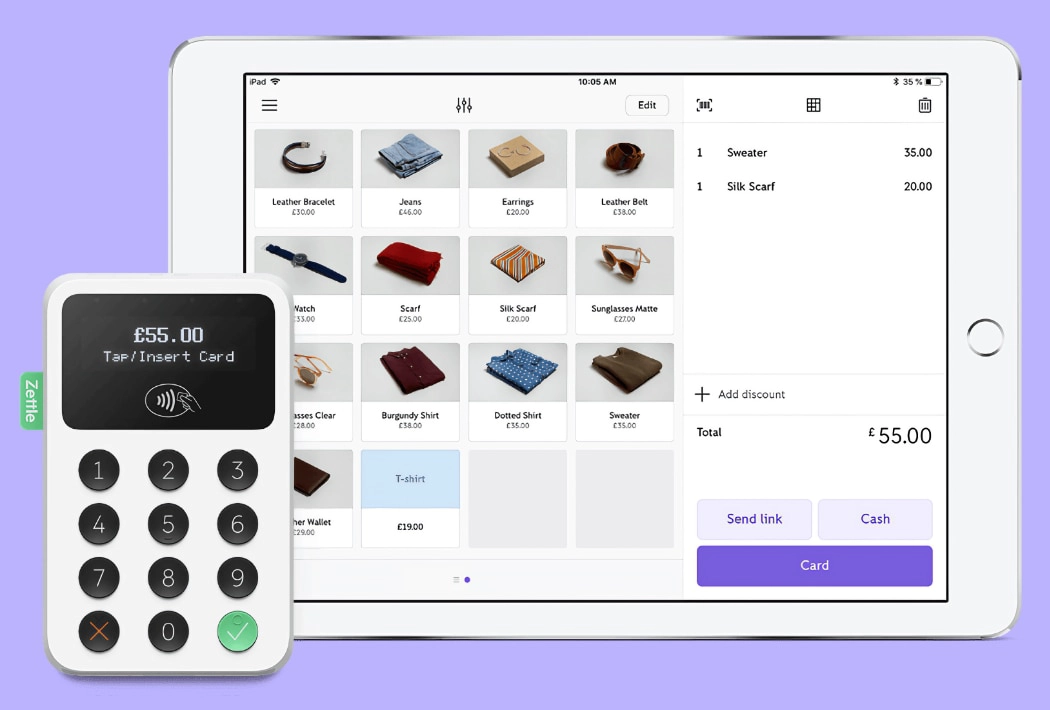

Then you can take a payment by entering the amount in the app and tapping “charge”. Transaction details are sent wirelessly to the card reader through Bluetooth, if using the card reader. The customer can insert their card in the card reader and key in their PIN, or tap it with a contactless card or mobile wallet.

Inventory items can be preprogrammed, complete with names, prices, descriptions and even images. Tapping a product image in the app adds it to the checkout bill. As such, this is more than just a payment terminal – the free software is a POS system in its own right with the mobile device working as a cloud-based cash register.

The black reader in the charging dock blends in well with dark countertops.

Those who need to accept multiple payments of the same amount quickly, for example street musicians or charity fundraisers, can request access to a Repeat Payments feature. This is not a default option in the app, so Zettle will need to grant you access.

Repeat Payments allows you to bypass that annoying step of entering an amount and payment method every time someone wants to tap a card. Instead, a fixed amount is automatically charged via contactless or chip-and-PIN, customer after customer without your input, whilst you play your song or do your work.

POS app features

The free point of sale (POS) app, Zettle Go, has enough features to work as a self-sufficient till system. Most – not all – of the below features of the mobile app are also included in the Zettle Terminal software.

MOBILE TRANSACTION

You can track inventory and get alerts when stock levels are low.

Product library and inventory: Add products – complete with image, description, types, barcode, and more – to a visually intuitive menu in the app, enabling you to just tap items to add them to the bill. Add a stock count to each item to help you to keep track of stock levels.

VAT and discounts: VAT can be added to receipts at the rates of 20%, 12.5%, 5% and 0%, and customised discounts can be applied to individual products or the transaction total as a percentage or amount in pounds.

Accepting cash: Cash sales can be registered in the app for free to make the system more useful for accounting. If you’re selling at a fixed till point, you can connect a cash drawer with a standard 24V or RJ11 plug, but it needs to be connected to a receipt printer to open.

Refunds: Refunds can be processed for the full transaction amount or individual items on a receipt. Currently, there is no option to refund custom amounts, nor can you refund tips.

Tipping: The tipping option will please food and drink businesses. You only need to enable this in your settings, then customers will be asked directly on the card reader display if they want to add a tip. If they pick ‘yes’, they can enter the tip amount manually before paying.

Tipping is a useful feature in the POS app, here shown on the first-generation iZettle Reader.

Receipts: After each transaction, there’s an option to send an e-receipt – customised in your account – via text or email. Printed receipts are also possible, but you’ll need to invest in a compatible receipt printer to provide these.

Barcode scanning: Use your phone camera as a barcode scanner, eliminating the need for a separate scanner. We tried this on iPhone, and it works smoothly. There is currently no option to use the scanner for internal audits, so this is purely for scanning items at checkout (barcodes should be registered in the product library beforehand).

Invoicing: Invoice customers by email through the app. The customer can then pay securely by card directly through the emailed invoice. Regulars can even be added in a customer library so you only need to create a transaction, search for the customer and tap to send the invoice.

The card reader with its app on iPad.

In the backend, i.e. Zettle account in a browser, you have extra features not available in the app. For example, the Customers section shows email addresses so you can invite customers to join your mailing list, and you can add staff members with different logins to separate their sales in the analytics section.

Payment links and QR codes

Zettle has a pay-by-link option, which is the ability to send a unique link via text or various apps (e.g. Facebook Messenger, email, WhatsApp), which the customer can click to pay through from their end. Payment links are different from email invoices because they only register in your system once they are paid – there’s no payment due date and the customer is not obliged to pay.

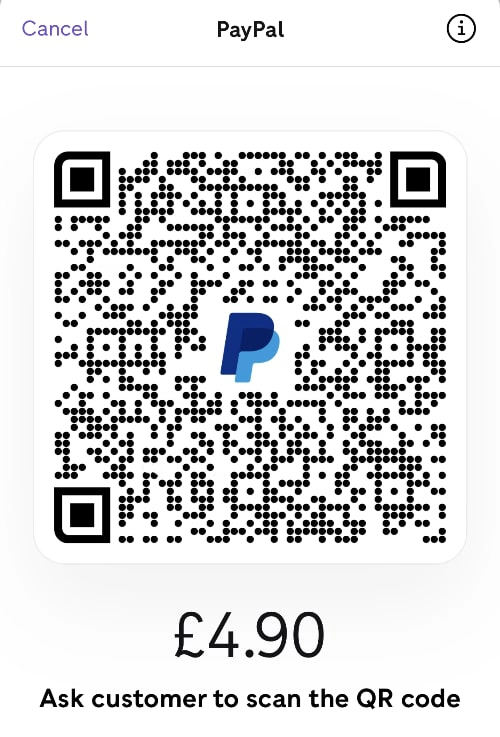

MOBILE TRANSACTION

Zettle QR code.

The only information the seller needs to enter before requesting a payment is the name and contact detail of the customer.

Payment links have proven to be a flexible tool for business to get paid by customers during the coronavirus pandemic, for example by cafés and restaurants offering takeaway. The fee for payment links is 2.5% per transaction.

The latest addition to Zettle’s remote payments is a QR code payment option. At checkout, you just choose PayPal as the payment method, after which a QR code is generated and shown on your mobile screen. The customer then has to use their PayPal app on their phone to scan the QR code and complete the transaction. The merchant does not need to have a PayPal account to enable this, but the customer does because they’re paying through PayPal.

POS upgrades and ecommerce

Many small businesses will find the free POS features sufficient, but Zettle Go is not the only POS system that can be used with the card reader.

More advanced POS systems for both retailers and hospitality are available through integrations. You can, for example, use the reader with Vend, Revel, Tabology and Lightspeed. These have monthly costs charged through the chosen EPOS platform, while card payments are charged through Zettle.

Ecommerce integrations are available including BigCommerce, PrestaShop, Shopify, Shopware, ePages and WooCommerce. This ensures that your inventory and products are synced automatically between the in-store and online shops.

EMILY SORENSEN (ES), MOBILE TRANSACTION

Zettle is popular among small beauty salons and hairdressers, here pictured at Beaut Box, London.

All transactions are recorded, and full sales reports are always available, including cash sales if you’ve accepted these from the app.

Free analytics are included to help keep track of inventory and identify repeat customers, as well as helping to spot business trends, such as revenue growth and top-selling products.

All reports can be exported to Excel and CSV files. Those who require advanced bookkeeping can integrate with the cloud-based accounting and invoicing systems Xero or QuickBooks Online.

Integrate with Xero

Zettle data can be fed into Xero automatically. Offering all the standard features of a cloud accounting system, such as a live view of your bank balance, Xero also includes payroll functions.

Read more: Xero integration with Zettle

Who is it best for?

The Zettle platform is suitable for most trades and sectors. It’s used by a range of merchants from plumbers to barbers, retailers, street vendors, hairdressers, beauty parlours, taxi drivers to coffee shops and pubs.

The mobility of the payment terminals means it excels at trade fairs, markets, pop-ups and car boot sales. Many sole traders use the reader, but since the app allows for unlimited users with restricted permissions, it is equally suitable for businesses with employees.

It is, however, a fairly basic till system that is not sufficient for advanced inventory management or full-service restaurants.

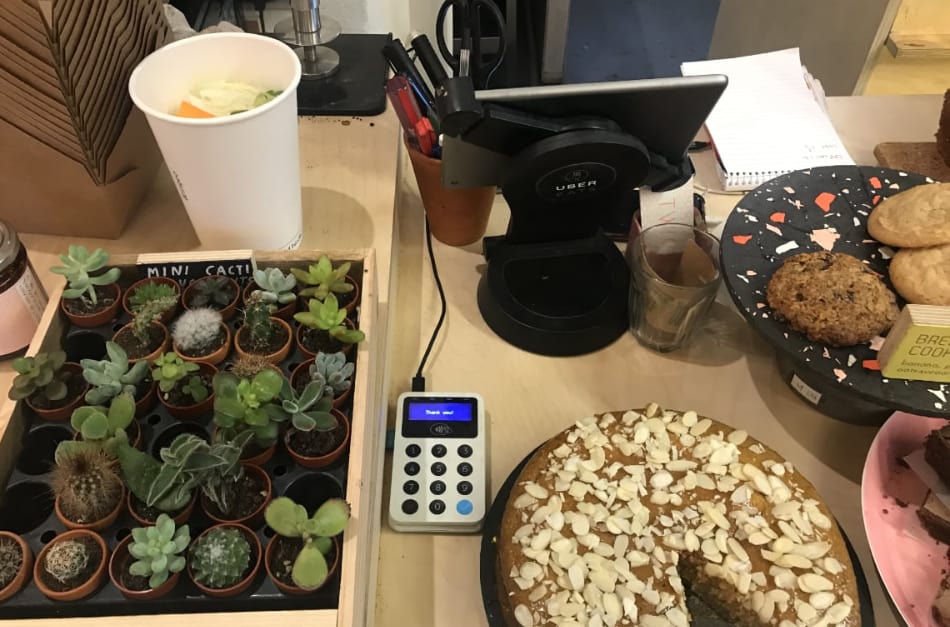

The free Go app doesn’t yet offer table layouts or split tenders usually required by restaurants, but features suit many smaller food-and-beverage outlets such as cafés. The card reader is actually thriving in this sector, in part because you can integrate with more comprehensive restaurant EPOS.

Out of the free till apps on the market, Square has the most features and would therefore be the best alternative for the till. There is also SumUp that is much faster at launching new features like online payments, a business account and ecommerce, but its POS features are more basic than Zettle’s.

Both SumUp and Square have been adding more features over the last years than Zettle, who appears more cautious about launching new products and features.

ES, MOBILE TRANSACTION

Zettle is a frequent sight in independent, British cafés – here pictured at Twigs Hackney, London.

That being said, Zettle Reader has long been the preferred card reader given its ergonomic design and easy-to-use app. Merchants may simply prefer this over competing card readers.

Zettle lets you send invoices and payment links, or show a QR code directly from the app. These are the only ways to sell without the card reader or customer being present, so businesses who need to take orders over the phone have to look for alternatives.

Like any other payment company, Zettle prohibits certain services and products from being sold through them. We recommend checking whether your business falls under any of these areas.

Customer support and Zettle reviews

Zettle’s customer service team is available to contact between 9am and 5pm on weekdays. You can phone or email them but will only get a response during those opening hours. It may take several days to receive a reply for non-urgent queries via email, so we recommend calling them during office hours for a faster response.

There is also a great online help section answering most questions that users have.

The company on average ranks highly in customer reviews. Reviews in the App Store average 4.7 stars out of 5 (based on 9k+ ratings) and 4.1 stars out of 5 in Google Play (based on 48k+ ratings).

However, recent complaints highlight lacking availability and poor responses from customer support, account holds, missing features on Zettle Terminal and other miscellaneous issues.

Several users complain about not being able to refund customers when there are not enough funds in their account balance, or they have to pair the reader with the app several times a day, implying the Bluetooth connection is not consistent.

Our verdict

Zettle’s free app features have long been a draw for mobile merchants. The integrated barcode scanner, invoicing and payment links elevate what could have been just a basic POS app to a complete payment system for your business. Currently, only Square’s breadth of free tools really competes.

Breakdown of Zettle rating

Product: 4.4

Costs and fees: 4.5

Transparency and sign-up: 4.8

Value-added services: 3.6

Service and reviews: 3.6

Contract: 5

= 4.3 stars

In addition, the company accepts a wide range of cards at a transparent, low rate where it’s usually the norm for card processors to charge high fees on foreign or premium cards like American Express.

All things considered, Zettle is hard to beat for any small business looking for a robust, uncomplicated and highly affordable point of sale that does precisely what you need it to do. True, customer support is not always available, but needing it should be rare because the system is easy to figure out and just works.

Pros

Cons

- Buy if: You want an easy mobile solution for taking a wide range of payments without a contract.