How it works

Dojo (sub-company of Paymentsense) is a merchant service provider that only just arrived in late 2020.

Its main offering is a touchscreen card machine (pictured below) that can be used on the go, at the till or around premises. It accepts contactless and chip card payments of the brands Visa, Mastercard, Discover, Diners Club and American Express and the mobile wallets Apple Pay, Google Pay and Samsung Pay.

Photo: Emily Sorensen (ES), Mobile Transaction

Box contents of the our Dojo Go package.

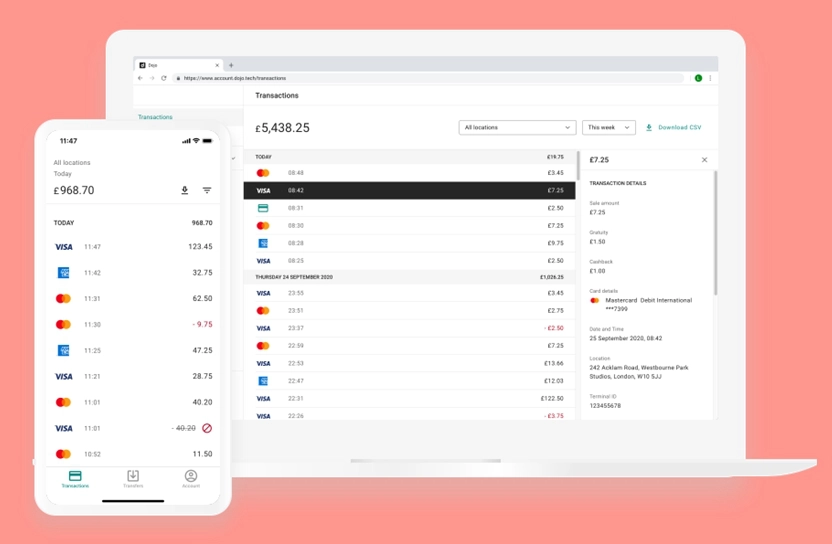

Through a merchant web portal or the Dojo app on your phone, you can view the progress of payouts and sales in real time. Sales reports can be downloaded, but it’s not yet possible to integrate Dojo with accounting software directly.

Transactions settle in your bank account the next day from 10am, even on weekends and Bank Holidays. This is pretty good in the industry, in our exprience.

In contrast with many card machine providers, Dojo has a commitment-free plan for businesses with an annual card turnover above £150k with a monthly cost, tailored transaction fees and additional service fees where relevant.

Otherwise, you sign up to a 6-month contract which is also not much compared to the industry norm of 12+ months.

If business funding is needed at any point, Dojo offers a cash advance powered by YouLend (subject to terms, turnover and credit history). This is repaid through a percentage of your card takings, with only a fixed fee added on top of the Dojo loan.

Card machines

Dojo offers just one card machine on a ‘Dojo Go’ plan: the beautiful, mobile PAX A920 smart POS terminal with a touchscreen.

On our ventures in shops across the UK, we know this is a very popular model now. It stands out from traditional push-button terminals that fewer people find attractive (however functional they are).

Tech specs of Dojo Go

The card machine is WiFi-enabled and connects with 3G or 4G through the built-in SIM card with unlimited, free data. During our tests, this allowed us to accept cards anywhere through the mobile network. We also love the fact that the 3G/4G connection is there as a backup if the local WiFi stops working.

The battery life is pretty good at up to 10 hours’ from a full charge, which is more than many terminals we’ve had our hands on.

Photo: ES, Mobile Transaction

Dojo Go is a handheld, portable terminal that worked well for us and looks good.

Whether you use Dojo Go on the go, for table-service, queue-busting or at a till point, multiple terminals can be added to the same Dojo account.

The terminal can be used independently or integrated with a compatible point of sale (POS) system. Currently, over 500 POS providers can connect with Dojo.

With a POS integration, transactions on the till communicate smoothly with the PAX terminal to accept payments at the right time. In addition, POS systems automatically register Dojo card payments in their sales reports.

Although a Dojo terminal cannot directly integrate with accounting software, a POS system integrated with Dojo can. Dojo transactions would then be fed into your chosen accounting system through the POS software.

So how does it work? I received a new Dojo Go terminal, well-packaged in a hard cardboard box. It comes with a USB charging cable, wall adaptor, charging dock and decals to show what cards you accept. To me, it was really easy to set up. The booklet included showed exactly how to do it in a few steps.

To take a payment in standalone mode, I just entered a transaction amount. After this, the customer can add a tip if they want on the screen, followed by the on-screen prompt to tap a contactless card/mobile device or insert a chip card (the PIN pad is displayed on the screen).

Photo: ES, Mobile Transaction

Our Dojo Go checkout screen.

Photo: ES, Mobile Transaction

Tipping options on Dojo Go.

As I tried the card machine, I frustratingly found out there is no option to add a transaction description to say what is sold. If you need this for reporting, then Dojo Go in standalone mode isn’t going to work. Integrating with a POS system allows you to link transactions with products, though.

The payment process is pretty fast on PAX A920, ending with a clearly displayed green tick to show the transaction is complete. We could then choose whether to print a receipt through its heat-based thermal receipt printer.

In terms of security, Dojo terminals use point-to-point encryption (P2PE), a high security standard developed by PCI-DSS that will protect your and your customers’ data.

There used to be a “soon to come” Dojo One plan advertised as a stationary card machine option, but this is no longer shown on the website.

Merchants can check transactions and payouts through the Dojo app or web portal.

Contract

If you’re a merchant switching from another merchant service provider, Dojo can pay most of your exit fees from the old contract you were locked into. This could be up to £3,000 if you’re going for Dojo’s bespoke plan, or £500 for the fixed pricing plan.

Dojo advertises “no long-term commitment” with a monthly plan, but only for businesses accepting over £150,000 annually in card payments.

If your business is making less than than, you get a 6-month contract. Cancelling before the end of this period incurs an early termination fee equivalent to the remaining costs of the contract. Without a cancellation, the contract will continue on a monthly rolling basis after the six months are up.

Dojo fees

There’s a fixed, monthly rental charge of £15 or £20 + VAT for the Dojo Go plan along with transaction fees based on your turnover and type of business.

On top of that, a range of service-related charges apply that you will have to enquire about while signing up, as not all fees are disclosed openly.

| Dojo pricing | |

|---|---|

| Contract length | Card turnover below £150k/yr: 6 months Card turnover above £150k/yr: Monthly |

| Setup fee | None |

| Fixed rental cost | Below £150k/yr card turnover: £20 + VAT/mo Over £150k/yr turnover: £15 + VAT/mo |

| Transaction rates (under £150k turnover) | Consumer Visa, Mastercard, other debit/credit cards: 1.4% + 5p Business debit/credit cards: 1.8% + 5p Amex: Custom fees |

| Remote or online transactions | Consumer cards: 1.8% + 5p Business cards: 2.3% + 5p |

| Dojo pricing | |

|---|---|

| Contract length | Card turnover below £150k/yr: 6 months Card turnover above £150k/yr: Monthly |

| Setup fee | None |

| Fixed rental cost | Below £150k/yr card turnover: £20 + VAT/mo Over £150k/yr turnover: £15 + VAT/mo |

| Transaction rates (under £150k turnover) | Consumer Visa, Mastercard, other debit/credit cards: 1.4% + 5p Business debit/credit cards: 1.8% + 5p Amex: Custom fees |

| Remote or online transactions | Consumer cards: 1.8% + 5p Business cards: 2.3% + 5p |

Merchants with an annual card turnover of less than £150,000 (£12,500 per month) pay a monthly rental fee of £20 + VAT and the following transaction fees.

Rates are 1.4% + 5p for Visa, Mastercard and Maestro consumer debit and credit cards via chip or contactless processing, including for Discover and Diners Club. Business, corporate and premium cards have a higher rate: 1.8% + 5p per chip or contactless transaction.

American Express fees depend on your business, so a quote is needed for during registration. Amex typically costs more than other cards, e.g 1.6%-2.5% + fixed fee.

The fixed authorisation fee of 5p applies to all transactions. Though small, this raises the overall percentage cost of low (e.g. £5 or £10) transactions significantly.

For card-not-present transactions (online or keyed), you pay an extra 0.4% for consumer cards or 0.5% for business cards.

Those with an annual card turnover higher than £150,000 pay £15 + VAT for rental and personalised rates only disclosed at sign-up.

These fees are based on your type of business, card turnover, how you took the payment and the type of card (request details here).

Dojo may apply additional fees to cards issued outside the UK, like +0.05% if issued in the EEA or +0.95% if issued outside the EEA.

Miscellaneous fees explained

As with other card machine contracts, other fees apply.

One is the £24.95 monthly minimum service charge, the minimum you must pay for transactions each month, even if no sales went through. So if card processing fees amount to less than £24.95 during a month, you pay £24.95. If transaction fees are more, then you just pay the true cost of transactions. This is on top of the monthly terminal subscription.

| Dojo fees | |

|---|---|

| Monthly minimum fee | £24.95 |

| Refunds | 50p per refund |

| Chargebacks | £28 + VAT |

| Paper billing | £3.50 + VAT/mo |

| PCI compliance | Free if compliant £15 + VAT/mo if non-compliant |

| Early termination fee | Equivalent to cost of remaining contract |

| Dojo fees | |

|---|---|

| Monthly minimum fee | £24.95 |

| Refunds | 50p per refund |

| Chargebacks | £28 + VAT |

| Paper billing | £3.50 + VAT/mo |

| PCI compliance | Free if compliant £15 + VAT/mo if non-compliant |

| Early termination fee | Equivalent to cost of remaining contract |

Receiving payouts in your bank account the next day is free, including weekends and Bank Holidays.

When ordering the card machine, you get “free next-day delivery”. This is actually misleading because it applies to the moment they approve your application (before 4pm), which can take a few working days. So in reality, shipping may take a little less than a week from the point of signing the contract.

We have been assured that the next-day terminal replacement is free, but the official fee schedule indicates it can cost up to £400 + VAT per machine. This cost applies if you damage or lose the terminal. Technical faults outside of your control that can’t be fixed over the phone will result in a free terminal replacement.

PCI-DSS compliance is free as long as certain paperwork is completed by the deadline. Otherwise, it costs £15 + VAT monthly for as long as you are non-compliant.

Other fees apply to add-on features, services and account extras. These are not disclosed until you speak to a Dojo representative, but may include e.g. POS integrations.

Remote and online transactions

Dojo is not limited to in-person payments. The company offers a few ways to accept payments remotely as well without an additional monthly fee.

In the Dojo browser account, you can easily create and share payment links via messaging apps, email or text. The recipient can then pay online on their smartphone or computer.

Dojo can also activate a virtual terminal on the PAX A920 terminal, for taking card payments on behalf of customers over the phone. You just enter a transaction amount on the touchscreen, tip (if applicable) and customer/card details to complete the transaction.

In our experience as reviewers, these options are standard for a modern merchant service provider, but they are nonetheless useful.

Photo: ES, Mobile Transaction

Dojo card machine at Franze & Evans Cafe Hackney, which we visited.

Dojo compared with market alternatives

Among the card machine options in the UK, we’ve been impressed by how popular Dojo has been in the last couple of years. It is the card machine I see most across London in small shops and food businesses, so Dojo is doing something right to attract and retain its merchants.

We know it’s a good deal with a card turnover of at least £10k monthly, preferably more than £12.5k per month so you can get custom rates and a lower monthly fee. Otherwise, the monthly minimum service charge (£24.95), rental (£20 + VAT) and fixed card rates add up to more than alternatives like SumUp and Square that don’t have monthly fees, just a competitive pay-as-you-go rate of 1.69%-1.75%.

Takepayments is a contender similar to Dojo, with monthly and annual contracts suitable for merchants with a card turnover as low as £2k monthly. That’t because the rates are personalised even at that sales volume, and the monthly cost could work out cheaper if your average transaction value is high enough. Although Dojo has a great, easy-to-understand package, we are surprised that not more people opt for Takepayments, given its excellent, personal service and value.

Regarding integrations and online features for ecommerce and accounting, Dojo doesn’t have much to offer. Square’s platform has a lot more in that area without a contract, such as a free website builder, many remote payment tools and integrations with accounting, marketing, scheduling and other software.

Eligibility and sign-up

As with many other uncomplicated card machine contracts, only certain types of businesses are accepted. For example, high-risk businesses like travel agencies, adult entertainment and vape shops may be rejected. Charities and trusts are not accepted, but social enterprises are.

We know Dojo accepts small shops and food and drink, and not necessarily hairdressers with high transaction sizes. Businesses with lots of high-value transactions may be referred to Paymentsense for a longer-term contract with other card machine models.

So how do you get started with Dojo? You’ll need to fill in a web form for a quote, then a Dojo team member will get in touch within a working day to discuss your options and request documentation. Only after Dojo has received everything required from you will they provide a quote and share an agreement.

After signing the contract, Dojo will check and approve it and then send the card machine on the same day if it’s before 4pm, or the working day after.

All in all, you should be ready for your first card machine payment within a week.

During onboarding, Dojo requires that you read some PCI-DSS compliance documents about card payment security, then answer a few questions about it. This is actually a simple version of setting up PCI-DSS compliance, so it’s not so bad.

Sole trader or new business? Compare SumUp, Zettle and Square readers

Customer service and reviews

All Dojo customers can call the main support team with general queries seven days a week between 8am and 6pm.

Tech support can be reached until late in the evening every day (8am-11pm), which is particularly important for off licences, bars and restaurants. Dojo can log into devices remotely if an urgent card machine issue needs fixing.

From our look at Dojo reviews, the service has received a large amount of positive user reviews. We think this is due to Dojo’s ongoing push to get customers to review its product, but it seems people genuinely have a positive experience. From my countless taps and chip-and-PIN payments on a Dojo terminal in shops, I’ve only seen cashiers who are more than happy to use it rather than ask for cash.

As a newcomer to the market, it’s obvious that Dojo should put more effort into customer service. It will be interesting to see if they can keep it up in the long term, though it looks like it really has succeeded in that regard.

Our verdict: mostly positive

We think Dojo is a reasonable deal for small shops and hospitality businesses with a consistent sales volume of over £10k monthly. Restaurants, pubs, bars and food trucks benefit from tipping and a possible EPOS integration with the flexibility to carry Dojo Go around premises and beyond.

The PAX terminal has a long battery life and impressive technical specs, but using it independently does have its frustrations when you can’t add a description to individual transactions. The Dojo app is a joy for checking transactions, but the lack of accounting integrations could be a hindrance.

| Dojo criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 4 | Good |

| Value-added services | 3.7 | Passable/Good |

| Service and reviews | 4.5 | Good/Excellent |

| Contract | 3.7 | Passable/Good |

| OVERALL SCORE | 4 | Good |

If stuck in a pricey card machine contract, Dojo is attractive for its monthly rolling contract and the offer to buy you out of a current, inflexible contract.

Dojo is slightly less appealing for below-£12.5k/year-turnover merchants who can only get a 6-month contract. That said, it’s reassuring that the contract changes to a monthly rolling subscription after the six months.

Next-day payouts into a bank account are a real benefit in our view, but the monthly fee and minimum monthly charge for transactions could be too much for seasonal and low-volume businesses. Instead, you can save money by choosing a wholly pay-as-you-go solution without a monthly cost. Dojo fees could generally be more transparent, so we recommend being on the lookout for hidden costs when signing up.