What does EVO Payments offer?

EVO Payments is a global acquirer and payment processor that offers a standard range of payment solutions for any size business. This includes:

- Card machines

- Payment gateway for online stores

- Payment links

- Virtual terminal for telephone payments

The company operates across the world, serving over 550,000 businesses, but has a base in Birmingham for its UK merchants.

As with similar payment providers, onboarding requires a conversation with a sales rep, where you discuss needs and pricing. After signing a contract and receiving the chosen card machine(s), you can accept card payments settling in your bank account.

Accepted cards

A big strength is EVO’s acceptance of many card brands including American Express which normally requires a separate contract. You can also accept different currencies.

Merchants sign up to a contract that includes card processing, customer service and the chosen payment products.

When you rent a card machine, you’ll have access to a ‘Business Resource Centre’, a web portal where you see transactions, chargebacks, fees and exportable sales reports. This requires a web browser – there is currently no app to monitor these details. Online payments have its own web portal depending on the solution requested.

Card machines: 2 models

EVO Payments offers two card machines: Ingenico Desk 3500 (countertop) and Ingenico Move 3500 (portable or mobile). Although the choice is limited, these are standard card terminals in the UK and of good quality.

Both card machines print receipts and accept chip and PIN, swipe and contactless payments.

The terminals can apparently connect with “virtually any point of sale product”, but if you need to integrate with a certain EPOS system, we strongly recommend asking EVO directly if it’s possible. We’ve seen many POS systems that do not list EVO as an integration option.

The countertop model, Desk 3500, is designed for the till. It works with Ethernet (by cable) or WiFi with your local internet connection and needs to be plugged in a power socket to function.

Photo: EVO/Ingenico

Desk 3500 is designed for the till point.

Photo: EVO/Ingenico

Move 3500 can be used portably or on the go.

Ingenico Move 3500 is available either as a portable or mobile solution. A portable version comes with WiFi connectivity, which is ideal for table service on fixed premises. It has an extended battery life, though benefits from being plugged in its docking station when not in use. There is also a Bluetooth version that costs a little extra, since it helps keep the internet connection stable.

The mobile model has GPRS connectivity and includes a SIM card so you can accept payments on the go through the mobile network. It has an all-day battery charge.

If tipping is needed, EVO can activate this feature for you on any model. Different currencies can be accepted on the terminals to give tourists an option to pay in their own currency.

Alternatives: Best card machines for small businesses in 2022

Simple pricing below a certain card turnover

Out of all acquirers in the UK, EVO Payments has the most predictable price plan for in-person payments. A simple monthly fee covers all of the following:

- Card machine rental

- Merchant account costs

- Transaction costs within a fixed sales volume (any card type)

- Standard settlement

This pricing bundle is called “Ready Made” and suits businesses with a monthly card transaction volume below £9,000. The monthly charge depends on how high your sales are, as shown in the table below.

EVO Ready Made bundles

| Monthly card turnover included | |||

| £1,500 turnover/mo | £3,000 turnover/mo | £6,000 turnover/mo | £9,000 turnover/mo |

| Total monthly fee | |||

| £33 + VAT/mo | £45 + VAT/mo | £71 + VAT/mo | £94 + VAT/mo |

| Out-of-bundle transaction fees* | |||

| Debit: 1.4% + 1p Credit: 1.5% + 1p Other: 3.5% + 1p |

Debit: 1.1% + 1p Credit: 1.2% + 1p Other: 3.1% + 1p |

Debit: 0.85% + 1p Credit: 0.95% + 1p Other: 2.75% + 1p |

Debit: 0.65% + 1p Credit: 0.75% + 1p Other: 2.2% + 1p |

*’Debit’ and ‘Credit’ refer to UK-issued Mastercard and Visa cards. ‘Other’ cards include other card brands, premium, corporate and foreign cards.

During sign-up, you will be put on the most suitable card turnover limit. If card transactions exceed the agreed sales volume during a month, you will pay the transaction fees indicated above. If you expect sales to exceed £9k monthly, you will get a custom quote from EVO which will suit your needs better.

Included in the plan is one card machine of your choice: a countertop, WiFi or GPRS (incl. SIM card) model. If you want one with Bluetooth capability, an extra monthly fee of £3 is added. Additional terminals can be added for £16 (countertop, WiFi or GPRS with SIM card model) or £19 (Bluetooth model) per month each, excluding VAT.

EVO Payments requires an 18-month contract on all plans, which means that an early termination fee applies if you want to leave earlier. This cost varies depending on how soon you want to cancel it – the longer that’s left on the contract, the higher the cost (possibly in the £100s). 1-2 months’ notice is required.

| EVO pricing | |

|---|---|

| Contractual commitment | 18 months |

| Setup fee | None |

| Minimum monthly charge | None |

| Early termination fee | Applies (amount depends on months left of contract) |

| Refunds | 50p |

| Chargebacks | £15 |

| Next-day settlement | About 3 working days: Free Next day: £4/mo |

Since you already pay a fixed monthly fee on the Ready Made plans, there is no monthly minimum service charge. In fact, the monthly cost works like a replacement for the monthly minimum charge that other merchant service providers normally require, so EVO might not be cheaper in that regard.

For example, if you only accept £1000 on the Ready Made 3000 plan (where £3000 monthly sales are included), you pay the same £45 charge that month as when you accept £3000 in card payments another month.

Let’s contrast this with a pay-as-you-go solution. With Zettle, you only pay 1.75% for transactions accepted, amounting to £17.50 for £1000’s worth of transactions and £52.50 if you accept £3000. Zettle’s fixed rate is on average higher than EVO’s transaction fees, but fewer card transactions through EVO is more expensive when you’re not near the monthly maximum limit of your pricing bundle.

What about refund processing? It costs 50p per refund processed, which is comparable to other merchant service providers.

With EVO, merchants can use any bank account (linked to their business) to receive payouts the next working day for £4 per month. Standard settlement – taking up to 3 working days – is otherwise free.

If a customer disputes a transaction with their bank, a chargeback fee of £15 is applied.

Remote and online payments

EVO offers a standard range of remote payment options, including the following.

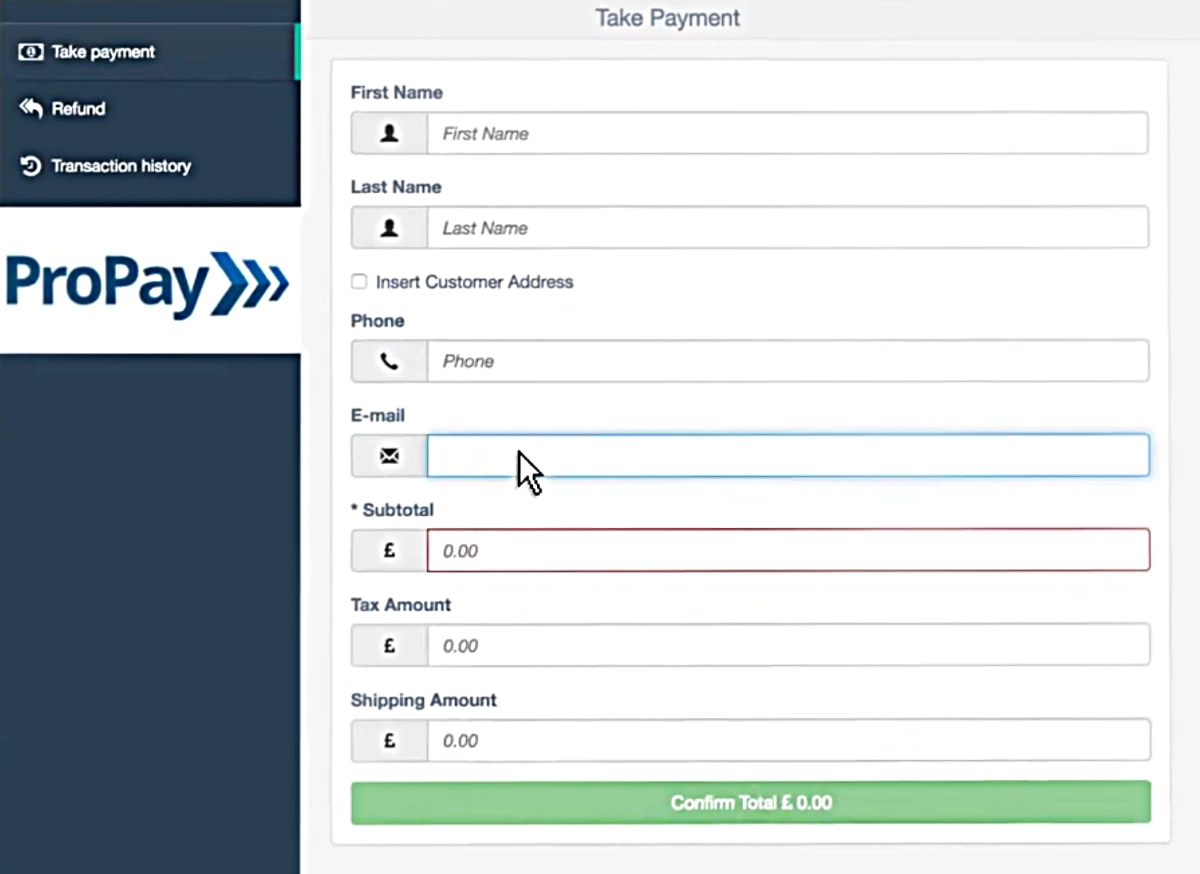

Virtual terminal: The virtual terminal solution is called EVO ProPay and costs from £6 monthly. It’s basically a web page where the merchant enters the card and payment details of a transaction during a phone call with the customer (can also be used for mail orders).

It fulfils all the industry security standards set by PCI-DSS and is best used on a computer or tablet with a large enough screen. EVO says it works on phones too, but there’s no app, and the browser page is not easy to navigate on a small screen. The virtual terminal can be used by several employees simultaneously.

The virtual terminal (ProPay) is accessed in a web browser.

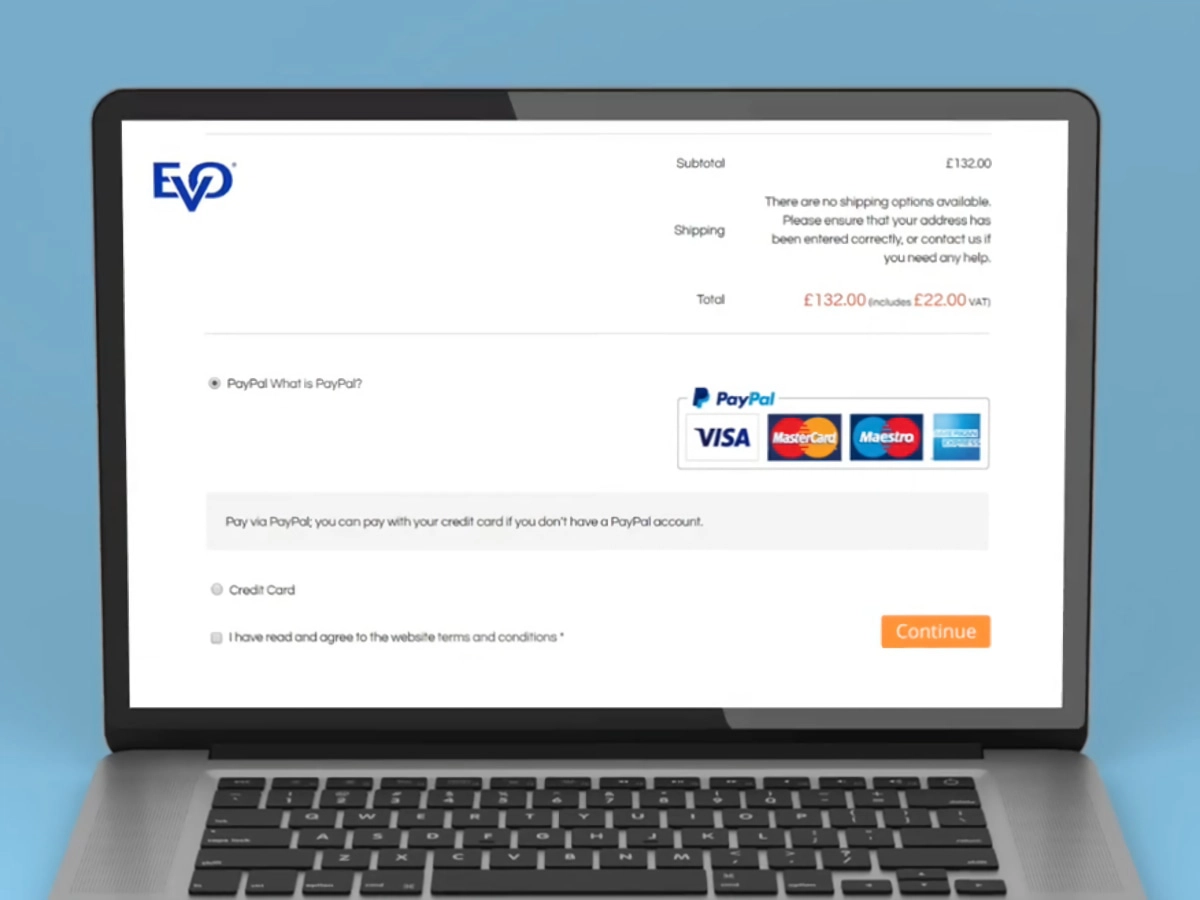

Online payment gateway: An online checkout page where customers complete a payment themselves, typically connected to an online store. EVO Payments’ gateway is quite customisable and connects with over 50 different ecommerce software like Magento, WooCommerce and OpenCart.

You can choose to have a standard checkout or fully personalised checkout to fit into any ecommerce flow. The solution incorporates standard security checks like 3D Secure, AVS and CV2.

Image: EVO Payments

EVO’s payment gateway accepts Visa, Mastercard, Maestro and Amex, with options for more.

Pay by link: A unique payment link or button sent to customers via email, text or social media channels, or displayed as a QR code. The link goes to an online checkout page, which is basically a payment gateway. Links can be integrated as a button on an email invoice, which can be customised in EVO.

Remote and online payments have its own browser dashboard, ‘Merchant Management System’, where you can monitor sales in real time.

Signing up

Signing up requires completing a contact form on the website, after which a team member phones or emails you back to discuss options. We requested a response via email which they respected by sending a full, no-obligation quote. You can also just call the company and discuss options straight away.

EVO Payments does not guarantee a timeline for how soon you are set up and ready for the first payment, so that’s something you should inquire about unless a speedy setup is not essential.

EVO Payments logo.

Once you’re signed up, you’ll be able to phone or email EVO 24/7 for support, with “core service hours from 8am and 8pm” which we assume means that not all queries can be dealt with outside the core hours.

We have seen reviews of slow responses during public holidays and generally slack responses after onboarding.

What about technical issues? As you visit the EVO Payments website, you (not everyone) may experience a tedious glitch: every time you load a page, the screen whitens completely for several seconds before you can actually view its content. Although not a serious problem, it would be extremely annoying if this happened in the web portal too.

There are multiple bad reviews that relate to an unresponsive customer support and problems cancelling the contract. It seems EVO’s service fares okay on average, though.

Our verdict

EVO Payments may not look like a trustworthy service with its website glitches, but it is worth looking at its fixed price plans for card machines when your sales volume falls below £9k monthly. Sales reps seem friendly and it’s not difficult to get a full quote.

The plans are suitable for any type of small business such as independent retail shops, cafés, restaurants, beauty salons, hairdressers and tradesmen. We wouldn’t recommend the quite average online payment features on their own, but they definitely suffice as an add-on for card machine users.

Compared to other traditional payment processors, EVO’s customer support fares better in user reviews, but it is not a perfect service. Cancelling the 18-month contract has been an issue for some, and the web portal for tracking sales and sending payment links are not ideal for mobile devices.